GOLD, Daily, H4 & H1

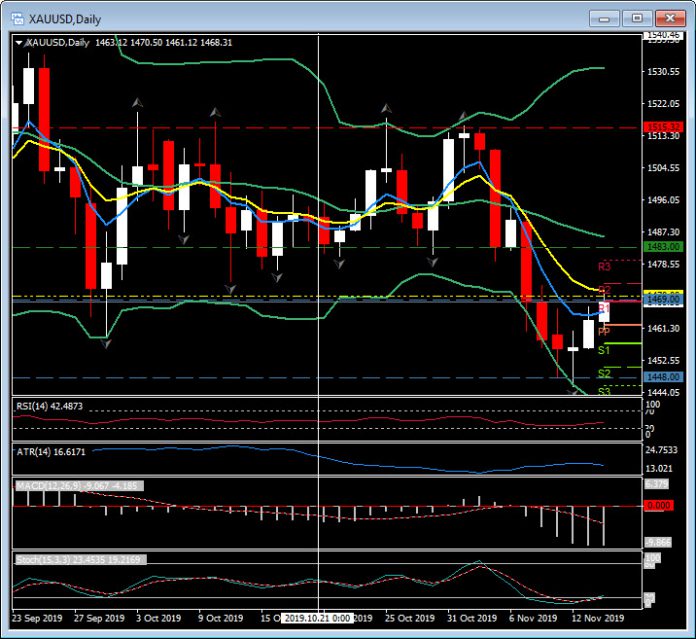

Last Tuesday (November 5) Gold closed down some $26.00, with a large bearish candle and below the key 20-day moving average. It had also closed below $1486 which had been a key Fibonacci extension level in the summer rally to $1555. The price paused Wednesday before another significant sell-off ($22.00) on Thursday (November 7). The close on Thursday took the price below the next key support level at $1470.00. Further falls on Friday and Monday occurred as the $1450 level was tested but the price failed to close lower again. Today, the price is re-tracing and once again testing back to the $1470.00 level.

The Crossing EMA Strategy (Daily) would have been triggered on November 5 with the price moving down to Target 1 (1 x ATR $1469) November 7 and Target 2 (2.5 x ATR – $1488) November 12 for a net gain of $35.00 or 3500 pips.

The H4 time-frame trigger LONG yesterday at $1462 producing T1 at $1467.80, T2 at $1476.00 and an initial Stop Loss, below the turn in the market at $1451.00. The H1 time- frame, from a failed move lower this morning during the Asian session, has turned higher This triggered a long entry at $1465.80, with T1 at $1468.20, T2 at 1471 .80 and an initial Stop loss at $1461.50.

The higher time frames (Weekly and Monthly) remain biased to the upside (despite last week’s very significant sell-off) and a breach and break on the Daily time frame back over the $1470-86 zone would be required to moves prices back towards $1500, $1515, $1535 and that summer high at $1550. Weekly support sits at $1440 and $1400.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.