The first two releases of PMIs are out, pointing pretty much mixed to negative outlook for the industry sector in November for both the German and Eurozone economies. On the one hand, the Services and Composite PMI readings disappointed for both economies, with strong indications that the weakness so far that started in the Manufacturing sector is now spreading to services. The Manufacturing outcome meanwhile, presented an unusual stabilisation of the manufacturing industry even though it remains in contraction territory.

The overall Eurozone manufacturing PMI rose to a still weak 46.6 in November, from 45.9 in the previous month, with both Germany and France signalling a slight improvement in sentiment, although at 43.8 the German reading remains firmly in contraction territory, while the 51.6 for France points to an acceleration in production, despite a still uncertain global environment. The French Services reading unexpectedly held steady at 52.9and the German Services PMI fell back to 51.3 from 51.6, which left the overall Eurozone number at just 51.5, down from 52.2 in the previous month. The last release of the European session was from UK, which also pointed to contraction in both Services and Manufacturing PMIs.

The Forex Market……

After the weak round of preliminary PMI readings, EGBs rallied led by Gilts as the data came together with ongoing doubts over US-China trade talks. This saw bond markets broadly moving higher during the early European AM session.

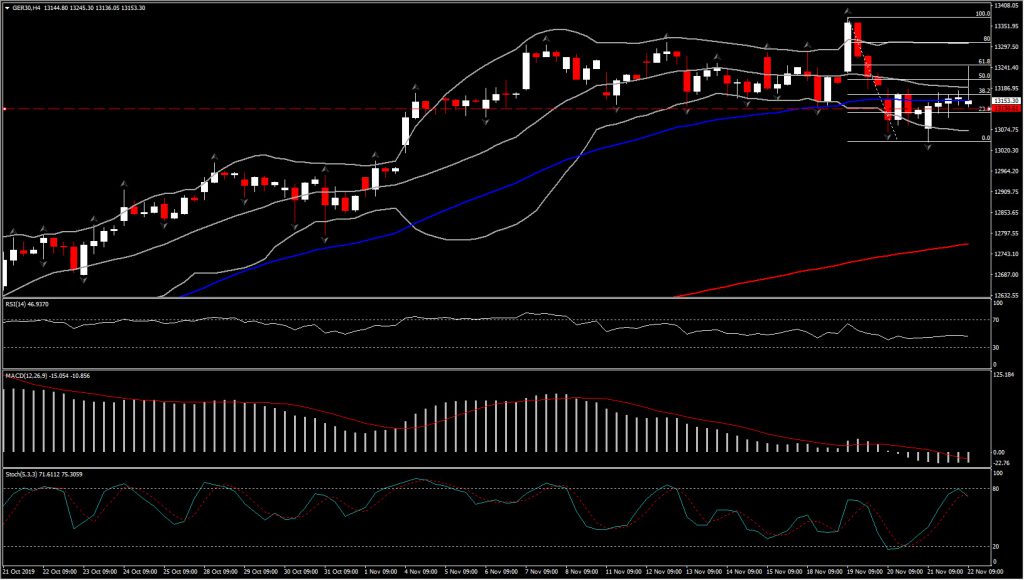

Stock markets moved higher, led by a 0.97% rise in the UK100, which got support from a weaker Pound. The GER30 is up a mere 0.19% for the second consecutive day, after the small corrective wave seen since last week.

The bulls managed to turn the asset above the 20-day SMA, however in the medium term the key Resistance persists at 80% Fib. retracement level at 13,308.55 (also 2 daily up fractals), with immediate Resistance at 13,249 (61.8% Fib. level since 13,382 highs). However for seeing such levels, in the short term, the asset needs to sustain a move above the 13,130-13,140 area, which remains a significant area as it coincides with 20-day SMA and the 2-week Support.

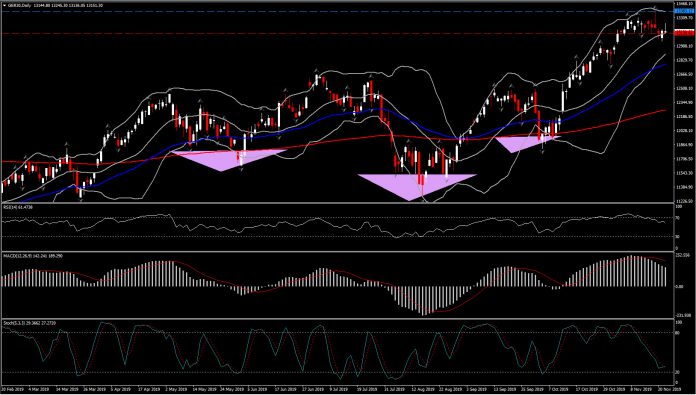

The momentum indicators are driving positively overall but neutral to negative intraday. In the daily timeframe, RSI has been flattening at 61, MACD is positive presenting however a decreasing positive bias while Stochastics are looking to recover above 20. Intraday on the other hand, RSI and MACD are negatively configured but hold close to neutral zone, while Stochastic has turned lower, however the signal line looks ready to stabilize.

Hence intraday indicators suggest that intraday weakness might just be a correction of yesterday’s rebound, while in the long term the outlook remains positive and could be re-strengthened if the key levels mentioned above (13,308.55) are surpassed. The latter could open the doors towards October’s pivot, January’s 2017 high or even towards fresh highs.

On the flipside, a rejection of 13,130 and a move below yesterday’s low could turn the near term outlook into negative one, with next Support levels at 12,893 (lower daily BB level) and 12,776 (50-day EMA), and if the latter breaks down as well then we could see a possible retest of 200-EMA, however this seems a distant scenario as the asset has been in an uptrend since August.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.