USDCAD, H1

US initial jobless claims were steady at 227k in the week ended November 16 following the 16k jump to 227k in the November 9 week (revised from 225k). Much of the recent volatility is likely a function of difficult seasonal adjustments around the Veteran’s Day holiday. The 4-week moving average rose to 221k versus the prior 217.5k print (revised from 217k). Continuing claims rose 3k to 1,695k in the November 9 week, after dropping -1k to 1,692k in the week of November 2. There was little apparent impact on jobless claims from the UAW-GM strike, but gyrations could pick up now that we’re entering the holiday season that extends into the MLK weekend in January.

The US Philly Fed Index rose 4.8 points to 10.4 in November after dropping -6.4 points to 5.6 in October, and is just shy of the 11.9 from last November. Today’s print stops a string of three straight monthly declines from a 1-year high in July. The -4.1 from February was a 3-year low. The components were mixed and mostly countered the better than expected headline. The November employment index fell to 21.5, after doubling to 32.9 in October. New orders plunged to 8.4 after edging up to 26.2 previously. Prices paid dropped to 7.8 from 16.8 and are down from 33.0 in September, with prices received at 12.2 from 16.4 in the prior month, and 20.8 in September. The 6-month index rose to 35.8 versus October’s 33.8, with most of the real components improving, including prices, though capex declined.

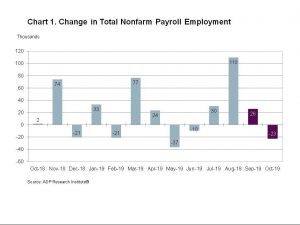

The Canadian ADP employment data showed a larger retraction of a fall of -22.6k vs a rise last time of +28.8k. “The labor market paused in October and most job sectors posted declines,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “However, leisure and hospitality experienced a gain likely due to the seasonality nature of the industry.” The September total of jobs added was revised down from 28,200 to 25,700.

Governor Poloz has just concluded a speech where he said that monetary conditions were “about right” – much less dovish than the market had been expecting, which bolstered the CAD and moved the USDCAD lower from the day’s highs. The combined news flow saw USDCAD initially rallying to 1.3324, three pips shy of yesterday’s high at 1.3327, before turning sharply lower on Poloz’s comments to breach 1.3300, and test S1 at 1.3267. The daily pivot point remains around the key 1.3300.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.