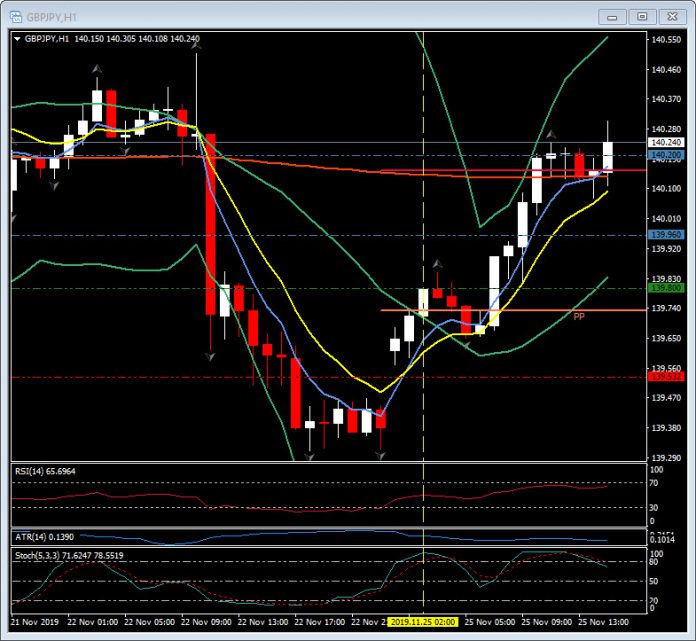

GBPJPY, H1

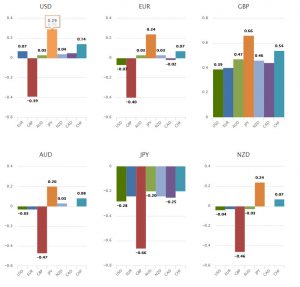

GBPJPY is the biggest mover on the day, showing a 0.66% gain, underpinned by both Sterling outperformance and Yen underperformance. With little more than two weeks to go until the general election, the latest opinion polls show PM Johnson’s Conservative party lead to have extended slightly, with Politico’s poll tracker showing 43% support for the Tories, up a point from Friday, and Labour’s support down a point, at 29%. This comes with the main parties having now released their election manifestos. Johnson will be taking some solace from this, with Labour showing no sign of the late surge in support they saw in the 2017 election. The Conservatives look to be on track to win an outright majority under the UK’s first past the post electoral system. This would enable Johnson to ratify the withdrawal deal with the EU and implement Brexit in January, at which point the UK would enter a transition period that would last until the end of 2020 (during which time not a lot would change in practical terms, with the UK remaining in the single market and customs union). As for the Yen, a reduction in the currency’s safe-haven premium has been afoot after Beijing pledged new measures to protect intellectual property, feeding hopes for progress in trade talks with the US.

When there is a strong currency and a weak currency, the pair has a strong bias in favour of the strong currency. In this case, a strong GBP and weak JPY combines to move the GBPJPY in a positive direction. The pair breached the key (H1) 20-period moving average at 01:00 GMT at 139.80 and has rallied over the psychological 140.00 to peak at 140.30, a move which represents over 2.5 (40 pips) of the H1 Average True range (ATR).

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.