Energy

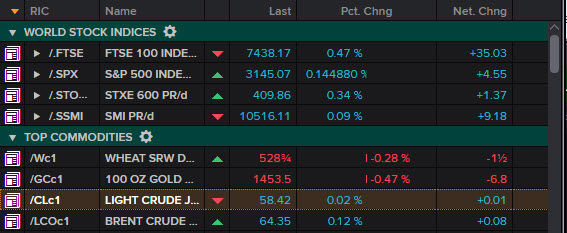

Front-month WTI crude prices rose over 2% from yesterday from the prior day’s lows, drawing back in on the 2-month high seen last week. The strength of Oil came in contrast with the fact that API reported a build of 5.954 million barrels of crude oil inventories for the week ending Nov. 15, and the US Energy Information Administration (EIA) reported an increase of 1.4 million barrels. This indicated that the key driver of oil is the trade talks.

The recent rise in oil prices has been concomitant with a risk-on sentiment in global markets after President Trump said that the US and China were in the “final throes” of hammering out a “phase 1” trade deal. Meanwhile on the OPEC front, in focus is the OPEC+ meeting in Vienna next week, in which the hot topic will be whether members will agree that the agreed cuts in place should be extended or made even deeper.

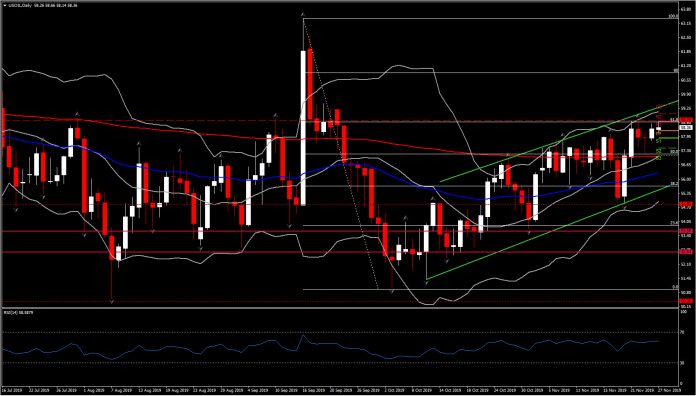

Meanwhile, despite the fact that trade hopes have supported oil’s demand side of the equation so far this week, the fact that we are in the mid of a short week due to Thanksgiving holidays, could overshadow USOIL upwards trend. USOIL is retestingthe 58.70 Pivotal High for the 5th day and the significant 61.8% Fib. retracement level from the September drift.

Despite the 8-week incline, the asset has been moving into a channel with noticeable retracements at Resistance levels, which followed the formation of the next swing lower. Hence as we move along, the retest of the 58.70 at the 61.8% Fib retracement level could see a correction lower to the key Support at the 57.00 level which is a confluence of 50% Fib. level and 200- and 20-day SMA. This lays 57.00 as a significant and strong Support level. However, such a corrective move would not be sufficient to reverse the overall positive outlook. Therefore any intraday weakness could follow another attempt for a configuration of a higher high.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.