USA500, Daily

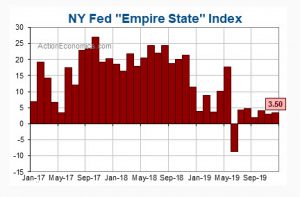

Today’s Empire State index rose slightly to 3.5 from 2.9 in November, missing expectations for a rise to 5.1. This leaves the index roughly midway between the 3-year low of -8.6 last June and the 2019 high of 17.8 last May. Component gains allowed the ISM-adjusted Empire State to increase to 51.7 from 50.9, leaving that measure also roughly midway between the 3-year low of 48.5 last June and the 2019 high of 54.0 last April. Today’s data likely benefited from a rising vehicle assembly rate and the positive news flow since summer setbacks for trade negotiations and global growth. Last week’s drop in uncertainty with the trade deal and UK elections were too late to impact today’s report, though prospects on these fronts had improved gradually since November, and stock markets rallied. The later month surveys should show a more direct impact of mid-December optimism. Expectations are that the ISM-adjusted average of all the major sentiment surveys to bounce back to 52 in December from a 3-year low of 51 in November, versus the 52-53 range over the five months through October. We’ve seen erratic, volatile sentiment swings in 2019 (just look at the May to June dive), around restrained levels that could be attributed to the competing opinions about the trade war and other global geopolitical events.

US Markit flash manufacturing PMI dipped to 52.5 in December versus 52.6 in November. It was at 53.8 last December. This is the weakest since October. The output index fell to 52.4 from 53.7 and also is the weakest since October. New orders slid to the lowest since October as well. Concurrently, the services index rose to 52.2 versus November’s 51.6. It was at 54.4 a year ago. This is the best reading since July. Prices charged rose to 52.7 from 50.3 It’s the third straight month of expansion and is the highest since February. And the composite index improved to 52.2 from 52.0 previously and is the best since July. The employment component increased to the best since July.

US Equities, opened with strong gains for the new week with USA500 trading over 3,190, the USA30 over 28,300 and the USA100 over 8,500, all at intra-day record highs. USD was mixed moving lower versus the Euro but gaining versus the GBP and the Japanese yen.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.