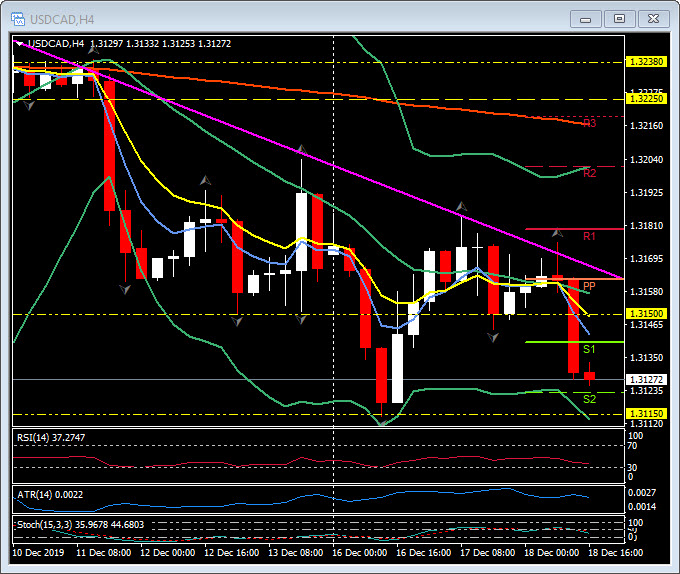

USDCAD, H4

USDCAD has breached below 1.3150 again today and is once again testing the six-week low at 1.3115 which was touched on Monday (December 16). This is the fourth consecutive week of declines. Earlier Canadian CPI accelerated to 2.2% y/y in November from 1.9%; although CPI fell -0.1% m/m, the data is supportive for the Loonie.

The Canadian Dollar has been benefiting from positive developments on both the USMCA and US-China trade fronts. The Fed’s removing a forecast for a 25 bps hike in 2020 at its FOMC policy meeting last week also weighed on USDCAD. Another supportive factor for the Canadian currency is higher oil prices, which are showing a near 9% gain from the lows seen in late November. USOil breached and broke $60.00 earlier this week and holds $60.50 today, ahead of the Weekly EIA inventories at 15:30 GMT which are expected to show a drawdown of some 1.5 million barrels. Assuming there are no upsets on the trade front, USDCAD looks likely to continue to trade with a downside bias.

Technically the pair have been moving lower from December 4 and the rejection of 1.3300 and the break and breach of the key 200-day moving average. Next significant support is 1.3100, the October low under 1.3050, and the 2019 low at 1.3015. A break back north of the 20-day, 50-day and 200-day moving averages, which are coalescing around 1.3225, would be required to reverse the downward bias.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.