CHFJPY

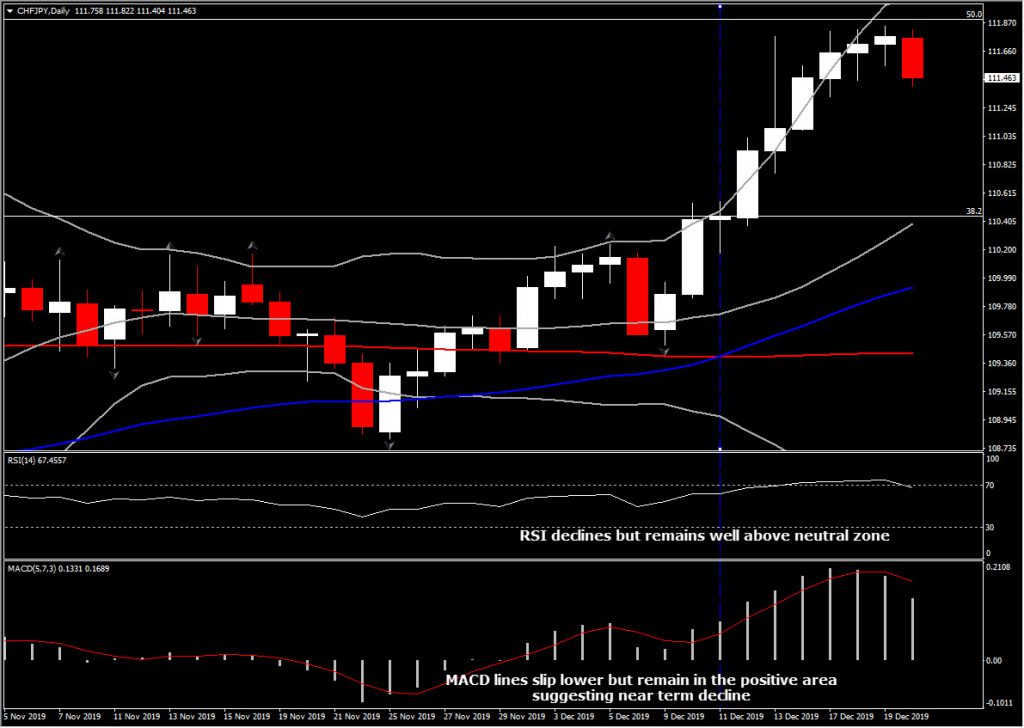

Similarly to USDCAD, which has been in a nearly 4-week phase of decline retesting multi-month levels, Swiss Franc is also seen close to Q1 2019 range against Yen and US Dollar. The CHFJPY has posted approximately 300 pips swing higher the last 4 weeks from 108.80 to 111.84, just a breath away from 112.00-112.50 which is year’s Resistance area. The latter is also the midpoint in November 2018 – January 2019 decline, which technically reflects to a significant area and we could therefore see a possible pullback close to it. The particular Resistance area has already started to show its teeth this week, as the asset fails for the6th consecutive day to gain momentum above the pivot 111.84 level.

Despite the latest choppy movement, the medium term momentum indicators present a steady positive bias progression with RSI rising for 4 months. It is currently above 60 in daily and weekly basis, lacking of any significant reversal signs that could turn the attention downwards. Weekly MACD lines rising above neutral, with the signal line posting a bullish cross, while daily MACD lines slip lower, suggesting that rallies will fade in the near term, before another trial to the upside again.

Hence, the formation of the 4-week uptrend with a series of positive candles where near term rallies are consistently being bought into, is leading the market higher. In the near term however, a pullback/consolidation might be seen. From the fundamental side, Yen could continue being under pressure as the risk-on vibe in global markets should maintain Japan’s yield-hungry investors’ confidence in foreign investments, while the Swiss franc has recently been inversely correlating with the ebb and flow of global stock markets, with the currency retaining its historic function as a safe haven unit despite the -0.75% deposit rate in Switzerland.

Therefore, the formation of a 3-week downtrend with a series of negative candles where intraday rallies are consistently being sold into, is leading the market lower. A decisive move above the 112.00, could confirm the increasing positive momentum with potential move up to 113 area. Immediate floor could be found at the confluence of 38.2% Fib. level and the 20-day SMA at 110.50.

Cautious should be kept ahead, as markets are winding down ahead of the Christmas and holiday period.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.