Netflix, Daily & Weekly

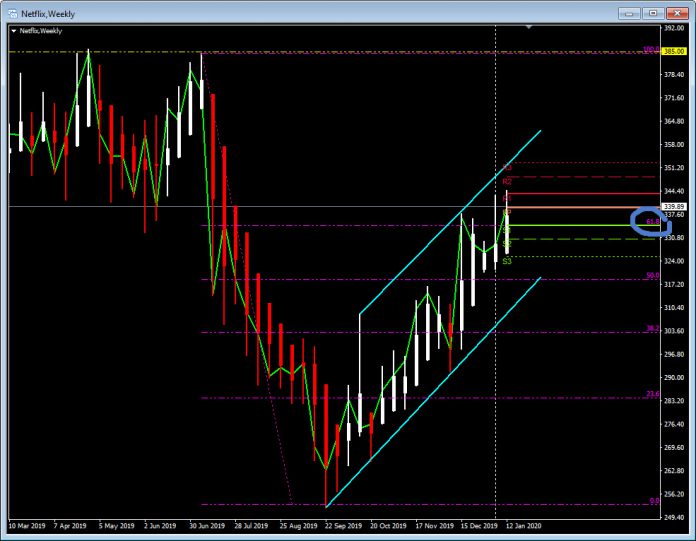

It’s been a volatile year for Netflix share holders with the shares flat over the last 12 months, compared to a gain of about 24.7% for the USA500. The price closed at $339.89 on Friday (January 17) but in the last 12 months the price has been as high $385 and as low as $252 (and even lower in the December 2018 equity rout that pushed the price down to $230.00).

So what is to expected from Quarter 4 earnings that are released later today, following the raft of competitors that have entered the media streaming world?

Probably the world’s leading media streaming company, Netflix saw its earnings per share and sales beat analyst estimates during Q3 but, following the company’s guidance about less than expected new subscribers, which followed similar news for Q2, the share price fell to the year low $252 figure on September 24. The share price is up some 34.5% from then. In the latest guidance, CEO Reed Hastings commented that the US price increase contributed to the reduction in subscribers, even though he commented that he wasn’t concerned about rival new streaming services. The company had earlier commented that the video streaming market is large enough to accommodate Disney+, Apple TV+ and Netflix. However, in the US, the streaming service will lose its two most popular shows – “Friends” and “The Office” – to upcoming rival services from AT&T Inc and NBC Universal in 2020 and 2021, respectively. Netflix valuations have long been driven by the subscriber numbers, often in preference to the earnings and revenue numbers.

In general, Netflix is expecting approximately 7.9 million new subscribers, compared to forecasts of 7.6 million, even though the increase in pricing is likely to increase its income. Even though subscribers are price-sensitive, it appears unlikely that the one-dollar increase in the monthly fees will have a material impact. It is more likely that the Disney+ platform, which launched globally November 12 at a much lower rate, $6.99 per month, (or discounted at $69.99 per year) is likely to take some market share from Netflix, even though it is still unknown whether the new venture will be profitable at such low rates.

The early numbers from Disney+ (with their enormous back catalogue) appear strong and Apple TV+ has a string of big names on board, although critically the programmes have been poorly received. Netflix remains the world’s largest streaming company and continues to invest heavily in original and new content, ramping up the debt levels.

Interestingly, the worst may be behind Netflix, and although new competitive services from AT&T and Comcast are due in the Spring, these are not on the same scale as the offerings from Disney & Apple. Also, since the launch of Disney+ & Apple+, the Netflix share price has outperformed, improving by some 16% compared to the 10% rise in the S&P500.

International subscriber growth has been key for revenues and this trend is likely to continue today with over 60% of subscribers being outside of the US. These international customers also tend to offer wider margins and more profitability than the US subscriber base.

As for the data today, consensus from 43 analysts polled by Refinitiv show an expected earnings per share of $0.51 on revenues of $5.45 billion. Netflix reported revenue of $4.2 billion during last year’s fourth quarter, leading to net income of $134 million, or earnings of 30 cents per share, and 8.84 million new paid streaming subscribers.

Of the 43 analysts who cover Netflix, 27 have buy or overweight ratings, 11 have hold ratings, and 5 have a sell rating, with an average price target of $367.04. The latest change came from Goldman Sachs earlier this week, with a very bullish outlook. Goldmans hiked their Netflix price target to $450 per share from $400 per share, implying a 32% upside for Netflix from Friday’s close at $339.67 per share. They were also bullish on subscriptions, suggesting that Netflix’s deep roster of movies and shows in the fourth quarter could propel its fourth-quarter subscription additions to 9.7 million — well above guidance of 7.6 million.

The Netflix numbers are released at 21:00 GMT later today, and all eyes will be on those key subscriber numbers, both domestically & internationally, along with any comments regarding the new competitors.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.