You might be wondering how a virus can affect the markets and significantly the Oil outlook. The answer to this is related to the current and potential demand growth.

A simple explanation for the 20% drop in oil prices in January was the issue of coronavirus and potential implications of an outbreak despite the fact that we are in the first stage of this epidemic. Hence. the fear that coronavirus could affect the potential oil demand from the world’s largest oil importer, China, weighed significantly on Oil markets.

Outside of Hubei province, Wenzhou, a city 700 kilometers from the epicenter of the outbreak is the first city to have quarantined its residents,9 million people. The Chinese government extended the New Year holiday, while many airlines have cut flights. Some airlines are cutting all flights to mainland China, in some cases until March or April, while others are only scaling back flight frequencies. In addition, certain Chinese cities are on the no-fly list. For US carriers, Delta and American have suspended all flights to China, while United has cut scheduled flights, but will for now, continue flying to mainland China. Amid the coronavirus outbreak, American Airlines pilots’ union has sued the airline to stop flying to China completely.

Because of the cancellation of thousands of flights, as a direct result of the epidemic, falling demand for jet fuel started showing up in supply statistics.

At least 2/3 of China’s economy will remain shut this week, as residents are being told not to return to work or school, and to avoid public places. Traditionally during holidays, gasoil demand related to industrial actions decline, while fuel for transportations increase as people travel back home.

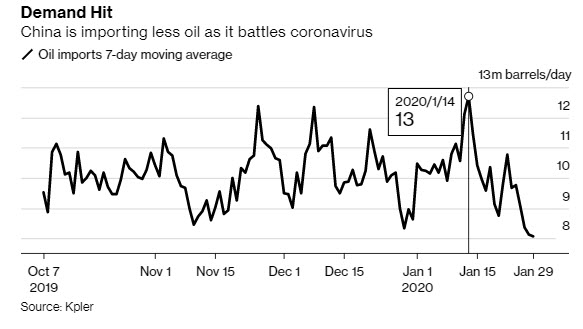

However, this year, things are way different as the fear of a pandemia is growing day after day. China is importing less oil as China’s industrial firms saw the first annual decline in profits in four years in 2019 amid the slowest economic growth in nearly 30 years. This is the worst shock in oil markets since the global financial crisis. Chinese oil demand dropped by 20% (usual daily consumption up to 14M barrels), as Chinese exports fell, while February could present sharper collapse as coronavirus cases and geographical spread escalates.

Additionally, oil prices could suffer further as there is a possibility of many Chinese oil refineries to announce rate cuts or their complete shutdown. Many Chinese oil refineries have already started storing the unsold petroleum products. However, many of them could reach their limits soon, and if this happens it can result to a reduction of the amount of crude processed.

Oil plummeting has push Saudi Arabia to call for an emergency OPEC+ meeting to discuss about the oil market in light of the coronavirus outbreak in February. As CNBC reported, Representatives from OPEC are reportedly planning to meet on Tuesday and Wednesday in Vienna to discuss options to mitigate the impact of a loss of demand arising from the deadly coronavirus outbreak. It is unclear at this point, if the cartel will discuss further production cuts in order to stabilize the price.

Beyond the headlines, USOIL slid to $51.52 lows so far today, levels last seen on August 4 of 2019. Mounting coronavirus concerns, and the impact it may have on growth in China, and indeed, the globe, are expected to continue weighing on prices for much of this month.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.