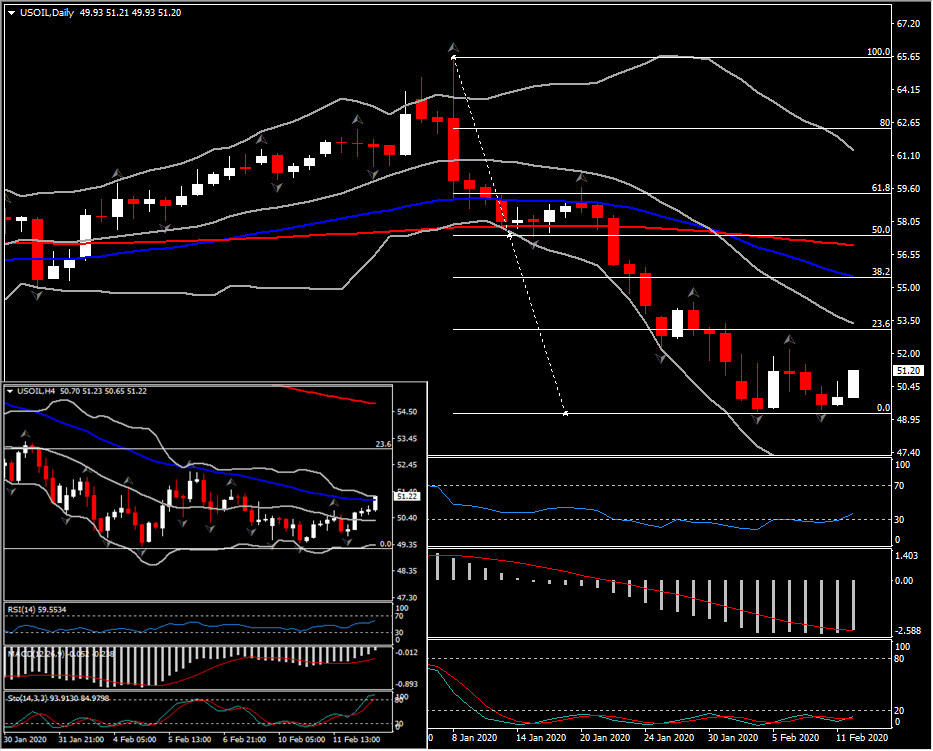

A risk-on backdrop, amid receding concerns about the coronavirus outbreak, has boosted the Dollar bloc currencies and Oil prices, which is a particular boon for the Canadian currency.

Nevertheless in the long term, the Dollar, underpinned by the relative robustness of the US economy, continues to register as the strongest main currency on the year-to-date, with gains of around 4% versus the antipodeans.

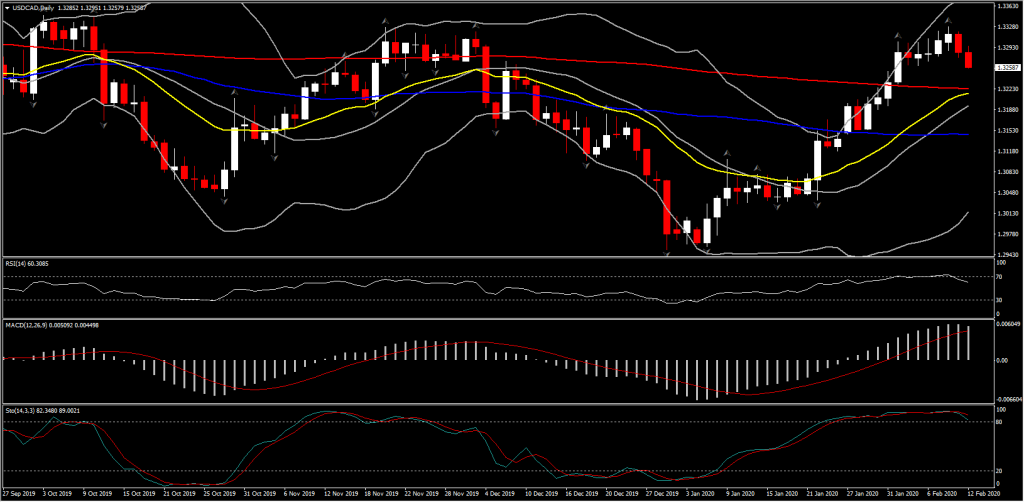

USDCAD fell to a six-day low at 1.3260, extending a correction from the 4-month peak that was seen on Monday at 1.3329. If the risk appetite continues to pick up in global markets and concerns about the impact of the coronavirus outbreak recede, this could help Loonie to further extend its correction from the key 1.3300-1.3350 Resistance, as a result of crude prices performance. However this is a reversal that still needs further confirmation.

Meanwhile, positive momentum has faded slightly, with RSI turning below 70 while Stochastic has posted a bearish cross, however it is still sloping above 80 (not yet a confirmed bearish momentum). MACD, in contrast, retains upside potential in the medium term. Next key Support for the pair stands at 1.3222 (200-day SMA). A decisive move below it could generate fresh negative bias and could open the 1.3100 area.

However bear in mind that Crude and the factors influencing it remain the key catalysts for Canadian Dollar exchange rates.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.