Global equity markets have been able to see through the bearish threat from the spreading Covid-19 with nearly all indexes, excluding the CSI and the Shanghai Comp, higher on the month. Optimism that the virus won’t become a pandemic, and that the impact will be transitory (and fairly modest outside of China) are supportive. And helping underpin that hopeful outlook is the hefty amount of liquidity in the system, along with expectations for ongoing support from monetary policy. The PBoC’s injections have indicated that this is its “whatever it takes” moment. Chair Powell essentially confirmed in his testimony that rates will remain lower for longer. However, some distrust over China’s handling of the virus, weaker Q4 growth data out of Europe, and disappointing US sales and production figures will sustain a cautious tone near term.

Consequently, the ongoing worries over the coronavirus have been elevating stock prices and weighing on the metals and energy market. In the past few days though, marginal gains have been noticed for all Platinum, Gold and Silver that have taken them back into trendline resistance.

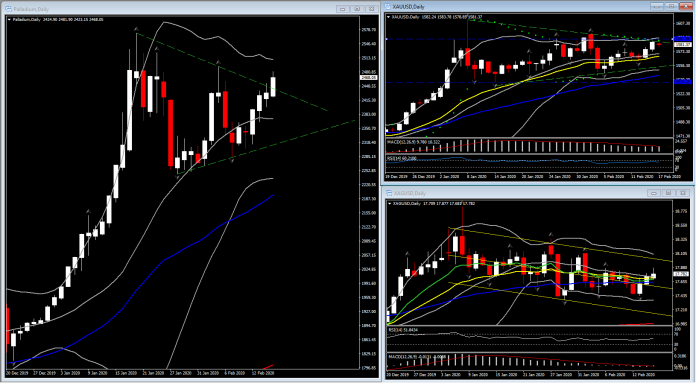

Gold and Palladium are testing the upper trendline of descending triangle formed in 2020, with the latter moving above it today. Palladium’s 4-day rally is gaining more positive momentum as it is trading in an upwards channel in the 1-hour chart. Technical indicators however suggest limited upside market in the near term, as RSI and Stochastic are struggling to overcome overbought barriers, while MACD lines have flattened, suggesting a possible sideways market in the near term. The latter agrees with the horizontalization of the BB lines. In the medium-term picture though, the sentiment is corrective to this multi-month rally of Palladium. Further stretch of the latest upwards move above 2,500 would turn the attention towards the continuation of Palladium’s epic rally.

Gold has been to the upside in February, posting a 1,584.97 high on Friday, before pulling back down again today on the absence of US markets. The medium term picture and the near term picture comply, suggesting a neutral to negative outlook for the precious metal. Currently, the price slopes southwards, confirmed by RSI’s reversal from 70 high and Parabolic SAR negative turn. MACD lines in contrast sustain bullish bias in the near term. To the upside, resistance holds at 1,593.75 ( 3rd February peak). On the flipside, should the bears take control, initial Support holds at 1,577 and the 20-day SMA, i.e. 1,570.45. A break of the latter could bring in focus the 1,535.86 and the 50-day SMA, which provides Support to Gold since December 2019.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.