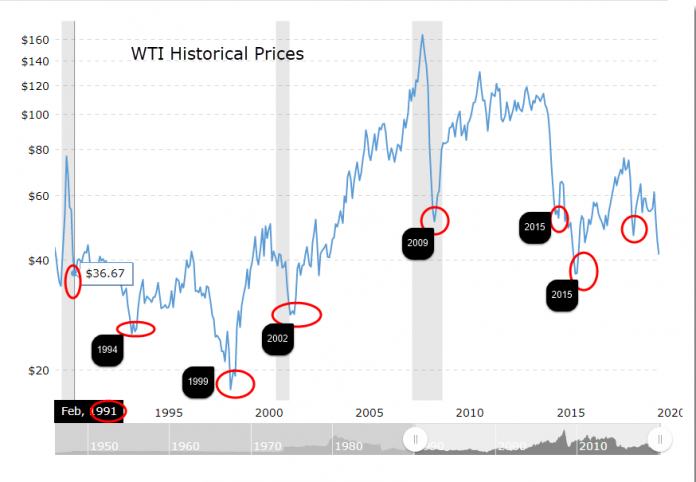

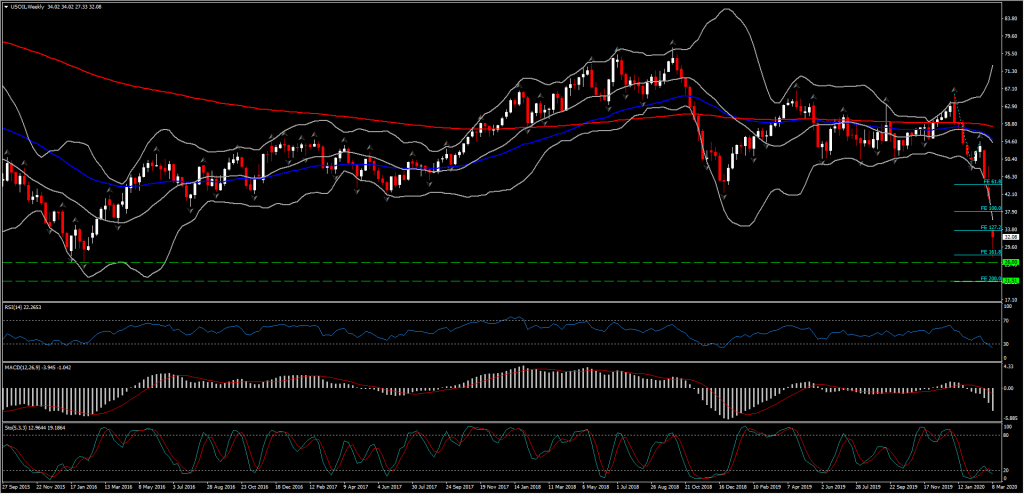

It looks like a black Monday as the collapse in oil prices triggered sharp reactions across forex, bond and stock markets. The breakdown in talks between OPEC and Russia on the management of oil supply has sent USOIL futures down, initially below $41.04 per barrel on Friday, to currently 4-year lows at $27.33. This staggering 30%-plus plunge was driven as Saudi Arabia clearly starts a price war with Russia, with the former unleashing output in response to the latter’s intransigence about trimming supply at a time of falling demand.

As Bloomberg stated, “the Gulf powerhouse cut its price for April delivery by $4-6 a barrel to Asia and $7 to the United States, with Aramco selling its Arabian Light at an unprecedented $10.25 a barrel less than Brent to Europe“. This clearly reminds us of 2014, when Saudi again kept its production stable since they decided that low oil prices offered more of a long-term benefit than giving up market share in an effort to force the US and Canada to abandon their more costly production methods (fracking) due to lack of profitability. After all, Saudi Arabia holds the largest oil reserves in the world hence it’s the only country that can withstand low oil prices for a larger time period than other without a significant impact to its economy.

The resulting carnage in oil prices has exacerbated virus concerns. Typically this level of crash could have winners benefitting from the oil bottom prices, such as the world’s biggest importer, i.e. China, whose recovery from the “known unknown” virus impact will be crucial for global economy.

However NOW things are different! Traditionally, increasing crude oil prices push inflation up and decreasing crude prices push inflation down. An Oil decline, if sustained, could increase global budgets, could worsen pressure in high-yield credit and pressure central bankers to halt a recession. However now that Covid-19 is keeping people at home, triggering fears of recession around the world and pushing Central banks for additional stimulus measures, the Oil shock has increased credit risks in financial markets and it might have an opposite dynamic.

Meanwhile, the collapse in oil prices has left markets in turmoil. The sell off in stocks accelerated and bonds continued to rally led by Treasuries, as yields have plunged to record lows. The US 10-year rate is below 0.5% now, the German 10-year down -14.0 bp at -0.854% and the UK Gilt yield down -12.7 bp at 0.102%. Needless to say these are all record lows and curves continue to flatten. The UK also joined the negative rate club and the two year is at -0.10% as pressure on governments and central banks rises.

USDCAD rallied by over 1.5% to a 34-month peak at 1.3758, and more gains seem likely if oil prices sustain weakness, which would mark a significant deterioration in Canada’s terms of trade. CADJPY fell to its lowest levels since November 2011.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.