The Canadian Dollar and other dollar bloc currencies are outperforming amid the return of risk appetite in markets. Oil prices rallied by nearly 1%, reversing yesterday’s losses. The Canadian currency will likely retain to near-term volatility as long as the coronavirus contagion remains in a state of increasing spread.

The Canadian Dollar has been the leader of the day, with renewed positive bias after the acceleration of Canadian inflation today. Canada’s CPI revealed the usual January pick-up, accelerating to a 2.4% y/y pace that came in just over expectations and followed a 2.2% y/y clip in December. The acceleration in total annual CPI growth, which is not adjusted for seasonality, came as month comparable CPI (also not adjusted for seasonality) climbed 0.3% (m/m, nsa) after the flat reading (0.0%) in December.

January has seen some sizable month comparable gains in recent years, so the resumption in month comparable growth is in-line with the usual seasonal trend and will likely be taken in stride by the BoC.

The late January BoC announcement featured Poloz stating that the door is open to a rate cut if needed, with a cut due to a meaningful miss on forecasts. The January CPI report shows total and core CPI running at or just above the BoC’s target, joining other recent data that has been at or above BoC forecasts. Hence, while the door to a rate cut remains open amid ongoing uncertainty over the impact of the Covid-19 virus, we continue to see the BoC holding steady through mid-year.

The oil-driven currency also found further support on the reports regarding the US sanctions on Russia’s Rosneft Trading, which have been cited as being behind the USOIL rally, to February highs of $53.16, up 1.5%. The sanctions intend to stop the flow of Venezuelan oil, with Rosneft Trading accused of helping Venezuela skirt previous sanctions. General risk-on conditions have been supportive as well, though ongoing coronavirus concerns will likely limit upside potential for now.

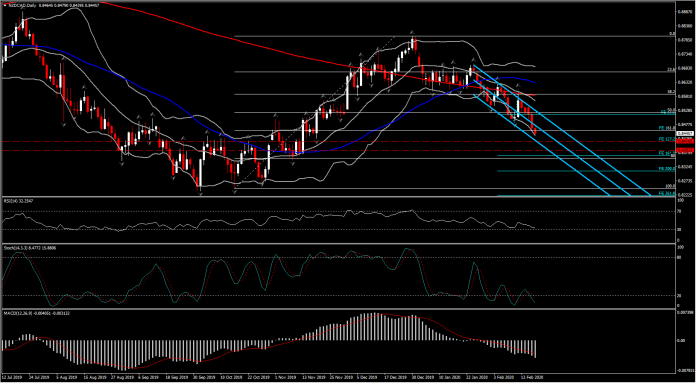

As Canadian crosses outperform, we have found NZDCAD extending its decline inside the clear daily Down Channel chart pattern. Today, the asset broke a key support area set at the 100 Fibonacci extension, at 0.8456, from the downleg from 0.8630 to 0.8485. The 100 FE coincides with the 61.8% Fibonacci retracement level from Q4 2019 rally. That said, 0.8456 could be interpreted as a significant strong Support area. Therefore today’s decisive move below it has refreshed the overall negative outlook for NZDCAD.

Nevertheless, NZDCAD’s lower Bollinger Bands pattern is extended to fall further, in line with its medium -term momentum indicators. RSI is at 32, Stochastic lines have already crossed below oversold barrier looking further southwards, whilst MACD confirmed another bearish cross as lines extended further below signal line in the negative area. All these would increase the possibility of rising negative momentum for NZDCAD, with next floor in the long term at FE161.8, at 0.8365. Immediate Support meanwhile could be seen at 0.8415 (FE127.2).

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.