The start of the week is dominated once again by COVID-19, but in Europe this time, with the number of confirmed cases rising rapidly in Italy. The stock market’s immunity to COVID-19 risk fell apart last week, pulling Wall Street down from record highs and knocking most global indexes lower. So far this week, European stock markets headed south once again, after a largely weaker close in Asia overnight. US futures are still up 0.3%, but have lost the majority of the gains seen overnight.

In the FX market, the safe havens’ demand dominated the market in February. Today, the Yen has picked up bids as stock markets in Europe sink and USA500 futures gave back most of the gains seen earlier.

The markets remain and are expected to remain strongly anxious for the next few months regarding:

- The rapid COVID-19 spread.

- Its economic impact on the already slow Chinese economy.

- The spillover degree to the rest of the world, with the markets in Europe struggling to shake off concerns about the economic impact the COVID-19 virus will have in Europe.

- Meanwhile in the US and in Europe the drop in Treasury yields and the decline in the Markit services PMI into contractionary territory are adding recession fears to the virus worries, even though FED officials believe that the richening in bonds reflects investor demand for safety and yields, rather than being a harbinger of a downdraft in the economy.

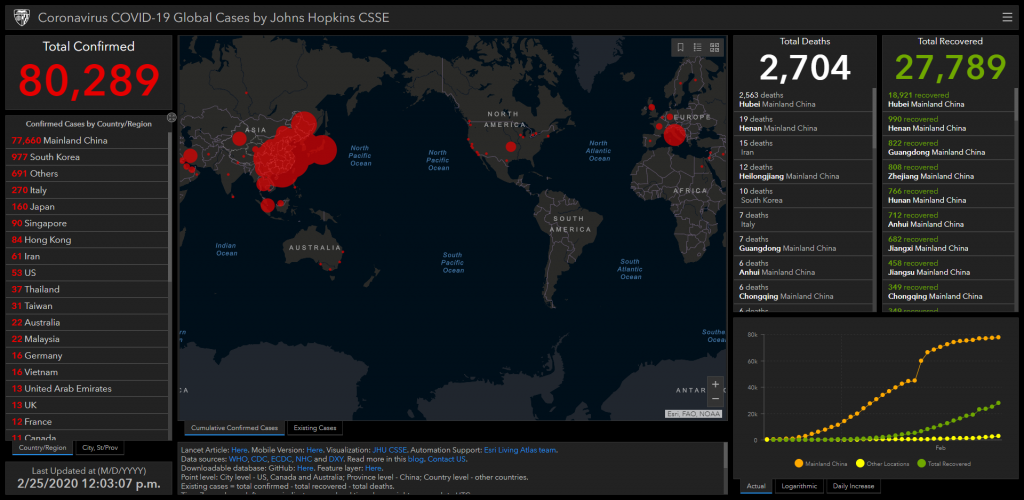

So far the latest confirmed cases for Coronavirus COVID-19 Global Cases as reported by Johns Hopkins CSSE are 80,289 globally.

However several publishing houses report that there is still hope to avoid a pandemic.

Reasons not to panic:

For one, comparisons with regular flu provides perspective:

- Total deaths from COVID-19 stand at 2,619 worldwide (according to the John Hopkins monitor), which compares to the over 10k deaths caused by regular flu in the US alone so far in the 2019-20 season (along with 180k hospitalizations).

- Also, there is scientific conjecture that the virus will naturally weaken as it spreads (a lowering in the “zoonotic force of inflection” or weakening in the rate of transmissibility, as is typical in virus outbreaks), which is highlighted by a report in the Lancet Journal, with April seen as likely to mark the point of peak contagion.

- The Wall Street Journal reports progress in developing a vaccine to COVID-19 virus, though a vaccine will not likely be ready for a while.

- The weekend acceleration in the spread of the virus in the Mideast and Italy has also galvanized many nations to either take action or make preparations to contain the virus.

However, as explained above there are several factors that keep a high degree of wariness appearing in market narratives.

In the following report you will find COVID-19’s impact in the markets.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.