There wasn’t much impact from the data as COVID-19 worries override fundamentals.

But what modest impact the data might have had, could have boosted fears. The stronger than expected January Durables report and unchanged 2.1% Q4 GDP growth pace did not ameliorate fears the outbreak will cut global growth sharply. In fact, the headline GDP number will be seen as old news, while the downward revision to business spending to a -2.3% clip from -1.5% in the Advance report might be taken as an ominous precursor to what’s to come.

Yields have slipped further with the 2-year now over 8 bps richer at 1.087%, with the 10-year 6.5 bps lower at 1.27%, while the Bond is down 6.2 bps at 1.762%, with the latter two making more fresh historic lows. The steepening in the curve reflects expectations for a Fed rate cut, with the March contract now pricing in a 25 bp easing with a little better than 50-50 probability. April is fully priced for a quarter point easing. However, with the virus quickly spreading across the globe other markets continued to sell off, especially after the BoK refrained from delivering the expected rate cut. South Korea is reportedly readying a fiscal support package and pressure on other governments to add fiscal stimulus will also rise as the virus continues to spread. Meanwhile, RNBZ’s Hawkesby was quoted as saying that monetary policy is not the right tool in response to the virus.

Stock markets remain under pressure. European stock markets continued to sell off during the AM session, after a largely lower close in Asia overnight. US futures are also in the red, although slightly off overnight lows.

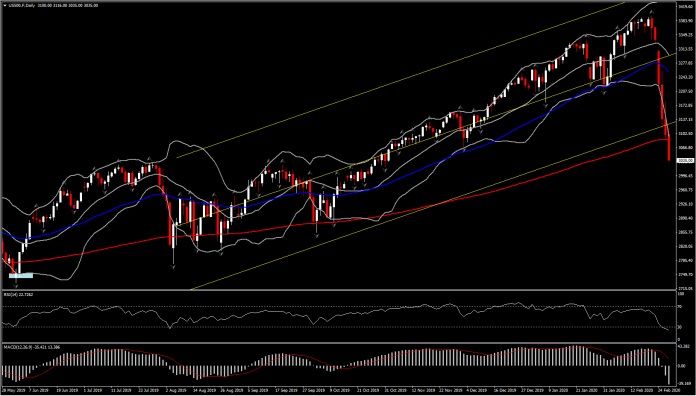

The USA500, along with many other stock indices, has faced strong pressure since last Thursday, which pushed the prices into a free fall reaction. The USA500 left behind the 7-month upwards channel and the 200-day SMA today (i.e. $3,053.00), which provided Support to the asset for more than a year.

The sharp decline seen this week was subjected to extreme negative momentum which does not look ready to stabilize yet, as the RSI and MACD lines are negatively configured into oversold conditions. That said, with the price of tha USA500 slipping below the 50% Fib. level established since the August 2019 rebound, the asset could find a near-term barrier at the 61.8% Fib. level at $3,012.00.

Meanwhile in the medium term, the 281-pip movement in the USA500 this week brings the overall outlook into an increasing downwards pressure.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.