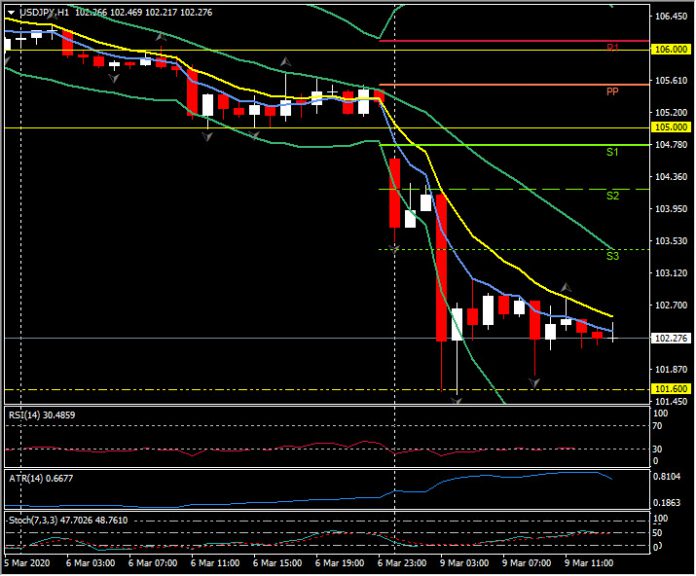

USDJPY, H1

The Yen surged by over 4% versus the commodity bloc currencies; massive intra-day movements by the standards of trading in the prevailing era as global markets slammed the risk-off button amid heightening panic about the global economic impact that the COVID-19 virus pandemic is having.

Oil prices were hammered, diving by a staggering 30%-plus, with the WTI benchmark hitting a $27.34 low. A price war has broken out between Saudi Arabia and Russia, with the former unleashing output in response to the latter’s intransigence about trimming supply at a time of falling demand. The resulting carnage in oil prices has exacerbated virus concerns. USDCAD lifted over 1.5% to a 34-month high at 1.3758, and more gains seem likely if oil prices sustained weakness, which would mark a significant deterioration in Canada’s terms of trade. CADJPY fell to its lowest levels since November 2011. AUDUSD, meanwhile, dove to a fresh 11-year low at 0.6320, while AUDJPY also descended farther into 11-year low territory.

USDJPY dove by over 3% to a 40-month low at 101.60, driven largely by safe haven demand for the Japanese currency. The Dollar has been trading mixed, gaining versus the commodity currencies and most developing-world currencies, particularly those of export oriented economies, while losing ground to the Euro and Sterling. EURUSD rallied 1.8% in posting a 13-month high at 1.1493, extending what has now been a 6.5% rebound from the 35-month low that was seen just 18 days ago at 1.0777. Ahead, the major “known unknown” remains how much the coronavirus spreads and how much economic damage from containment measures there will be before it becomes clear that the virus is on the wane. These are good times to be a long-term value investor.

How will US markets react later? The cash markets open an hour earlier than normal, for the next three weeks as North America moved to the Summertime, March 8 2020.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.