The UK was the latest major country to announce a strict lockdown, and while many governments have now adopted measures that encourage companies to keep on staff by subsidising pay during the time of restricted activity, there is still less support for the self-employed and freelancers and markets are still waiting for a co-ordinated move from Eurozone officials.

Today’s UK preliminary March composite PMI hit a series record low (since January 1998) of 37.1 in the headline reading, having plummeted from 53.0 in February. The manufacturing PMI fell to 48.0 from 51.7 while the services PMI haemorrhaged to a 35.7 reading from 53.2 in the month prior.

The data obviously reflects the impact of the coronavirus, having been compiled between 12-20 March, though precedes the nation’s closure of cafes, pubs, restaurants, clubs, concerts etc, and the nation going into lockdown, which started yesterday evening. The steepness of the month-on-month decline surpasses that seen even following the collapse of Lehman Brothers in 2008, which marked the start of a global financial crisis. The prior series low in the composite PMI was 98.1, which was seen in November 2008, two months after Lehmans fell.

The main takeaways are clear: that the economy is already in sharp contraction, and that worse is to come. A deep recession is inevitable, the key and as yet unanswerable question being how low it persists. Like other countries, the UK government has announced an aggressive stimulus package to counter the impact of virus-containing measures. The UK’s one is billed as an “employment retention” coronavirus support package, which was detailed last Friday and which aims to keep the economy primed for a V-shaped rebound by paying up to 80% of employees pay in businesses that have been forced to suspend trade. No matter how big the stimulus, there won’t be much scope for recovery until people can go back to work.

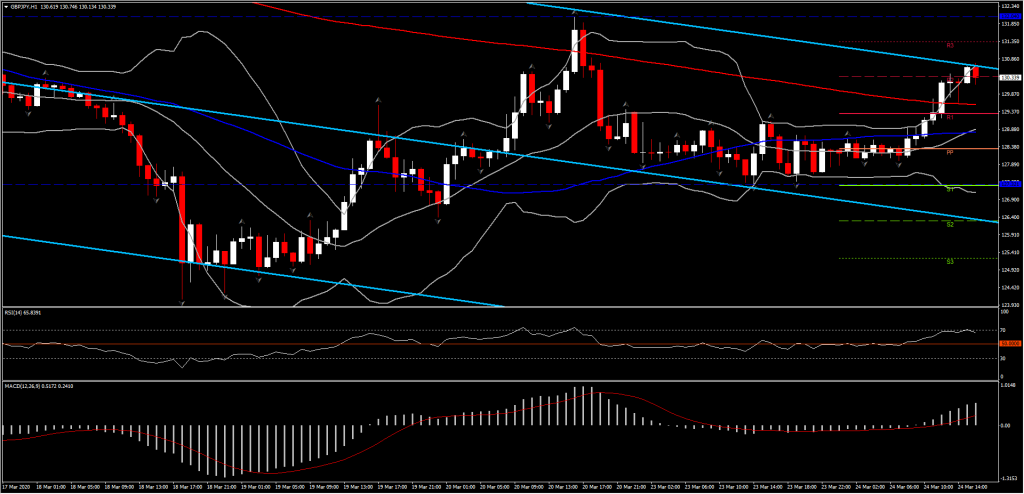

Today, Sterling is the strongest currency out of the main units, presently within a few pips of its highs and showing a 1.7% gain versus both the Dollar and Yen, and a 0.9% advance on the Euro.

The UK currency had been trading similar to a commodity currency lately, significantly underperforming its major-currency peers during phases of acute risk-off positioning, so it shouldn’t be too surprising to see the Pound outperform during the rebounds. Cable has printed a high at 1.1790, which is up by nearly 4 big figures from the 35-year low that was seen on Friday at 1.1409. The pairing is still showing a whopping 11.4% decline on the year-to-date.

GBP proved to be vulnerable during the recent phases of acute risk-off positioning. Additionally, to the above, the UK runs a relatively big current account deficit, particularly the part of it derived from foreign investors in UK assets, which dwarfs UK investors’ foreign investments and sets up an imbalance when it comes to capital repatriation. This could expose the currency during heightened risk aversion.

Then there is Brexit — Boris Johnson’s government is still aiming to take the UK out of its special transition membership of the EU’s customs union and single market at the end of the year, which would put a large part of UK trade on less favourable WTO terms (we think Johnson will ultimately opt for an extension in the transition period).

The BoE’s Monetary Policy Committee meets on Wednesday and Thursday, when it will release the minutes from last week’s decision to cut the repo to 0.1% and expand QE.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.