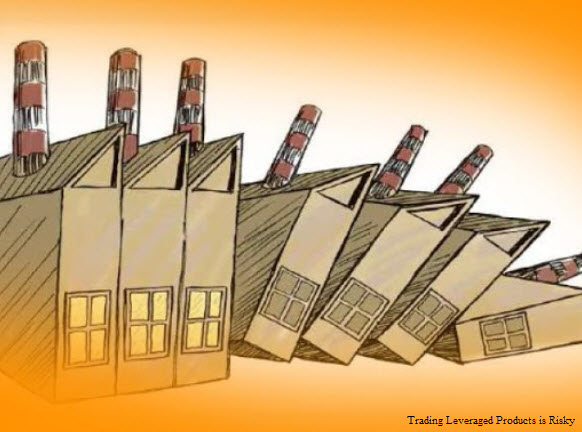

“Capital is not a thing, but rather a process that exists only in motion. When circulation stops, the value disappears and the whole system comes tumbling down”

—David Harvey, A Companion to Marx’s Capital, 2010, 12

Deindustrialisation is the reverse process of industrialisation, namely the decrease in the contribution of industrial sector, especially the manufacturing industry in a country. In this context, the decline has occurred in production and labor output so that the manufacturing sector has experienced a decrease in added value. This phenomenon is also often called negative deindustrialization amid the immature economic growth of a country.

COVID-19 first broke out in Wuhan, specifically the Huanan Fish Market, on December 31, 2019. Quoting https://coronavirus.jhu.edu/map.html the number of current cases has reached 741,030 with 35,305 fatalities and 156,838 recovered. Most cases are currently in the United States, with Italy at number 2, Spain at number 3 and China as the initial spread at number 4.

One of the economic possibilities as a result of the coronavirus pandemic that has begun to be seen clearly is de- industrialization. Physical imprisonment and lockdown has emerged as a consequence of the spread of COVID-19 that has destroyed the labor-intensive manufacturing industry as those involved in physical work have stopped travelling to their work locations. If this continues, we can easily see the unsustainable nature of this economic situation.

Daily necessities are generally produced from physical work that cannot be done at home. Rice, wheat, milk, cheese, eggs and other basic necessities will stop being produced if the workers stay at home. If the workers are at home, then supermarket and mall shelves will stop being filled with instant noodles, soft drinks, snacks, bread, tissues, etc. The physical workers will experience a massive degeneration into the lumpenproletariat . Thus, a blow to the manufacturing industry will sooner or later propagate and be a blow to all industries.

Venice before and after the epidemic.

Blows on the non-online entertainment industry range from cafes, restaurants, cinemas, malls, arts-cultural festivals to massage places. These businesses wholly rely on physical interaction. Religion has also been affected, which requires physical meetings and fellowship between people. At present activity has begun to shift to long-distance entertainment through radio, television and internet. The business model of every entertainment industry has been forced to change: home production, scaling down, distribution on demand etc.

https://finviz.com/map.ashx?t=sec

https://finviz.com/map.ashx?t=sec

The picture above is a display of stock prices from various sectors exposed to fear, and we can see not a scary coronavirus, but corona impact that is generating global fears that are turning off economic turnover. Like a nuclear bomb, there are long lasting effects similar to the nuclear radiation that causes birth defects, the development of cancer due to radiation and various diseases thereafter.

My friend told me today about the quiet business he has run in the last 3 months. The streets were quiet, shops were closed and turnover dropped dramatically, while bills from banks, bills from suppliers continued to have to be paid. Although there is a guarantee from the government to delay payments for at least one year, in practice the policy does not look enough. The first private sector has a significant impact from declining turnover and traffic jams here and there.

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.