The -261k initial claims drop-back to a still lofty 6,606k in the first week of April trimmed last week’s upwardly-revised 3,560k surge to a record-high 6,867k (was 6,648k). This followed a 3,025k pop to 3,307k from an elevated 282k 2-year high in the March BLS survey week, which marked the start of the COVID-19 impact. The market expected that claims will fall back sharply through April as furloughed and laid off workers with mandated shutdowns have had time to file claims. Claims are entering April well above prior averages of 3,048k in March, 214k in February, and a cycle-low 211k in January.

The April nonfarm payroll estimates sit at -11,000k, and we will use initial and continuing claims to calibrate the estimate as we pass through the BLS survey week, which is two weeks from today’s report. We assume that 1,000k of the April payroll loses are at factories. We assume a 100k April boost from Census hiring that will get lost in the sea of job losses..

Meanwhile in Canada, employment plunged -1,010.7k in March, about double expectations after the 30.3k rise February. Mandated business shutdowns combined with the collapse in oil prices gutted Canada’s job market in March, so the huge decline in jobs is not shocking. Full time jobs tumbled -474.0k and part time jobs dropped 536.7k following respective moves of +37.6k and -7.3k. The unemployment rate rose to 7.8% in March from 5.6% while the participation rate fell to 63.5 from 65.5. Hours worked contracted -14% y/y in March.

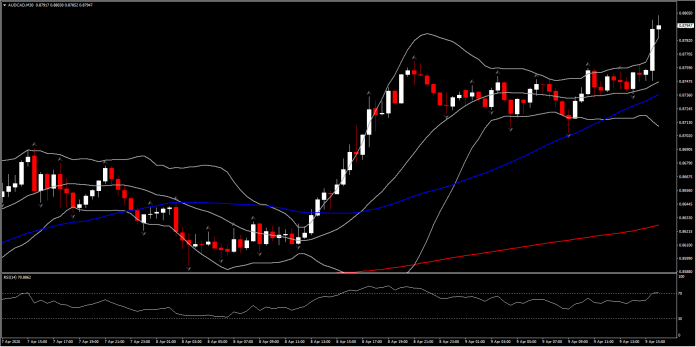

Canadian Dollar has taken a hit following a worse than expected blowout in Canadian employment data (dropping by over a million in the headline figure). AUDCAD is registering the biggest movement out of the main dollar pairings and associated crosses on the day so far, with a 0.5% gain at prevailing levels, which are only off the highs by around 6 or 7 pips. Most of the gain reflects broader strength in the Australian dollar, which has advanced in to 24-day high territory today, buoyed by recent gains in stock and commodity markets, while the Oil prices are also about a dollar off earlier highs into the OPEC+ conference-call meeting, which is about to kick off.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.