The commodity currencies have come under pressure with stock markets taking a step back in Asia today, and USA500 futures showing declines of over 0.5%.

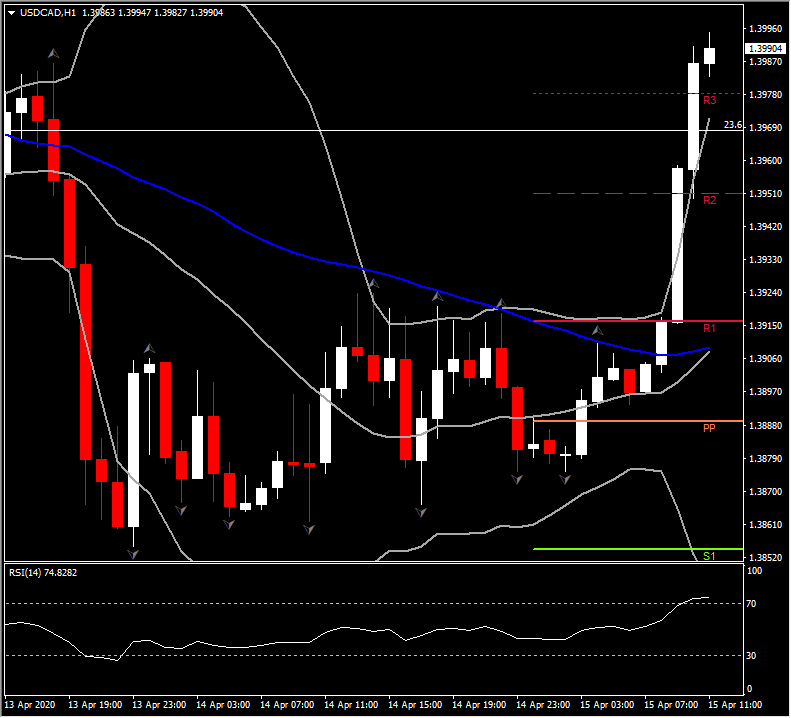

The Canadian Dollar has also declined, setting USDCAD up for its first up day in a week, with the pair posting a 2-day high at 1.3960, as oil prices remain on the back foot and as US Dollar. USOil prices have also remained heavy after it printed a 2-week low at $19.95 late yesterday, with the OPEC++ group’s near 10 mln barrel per day output cut, and hints of bigger cuts to Come, doing little to convince crude markets that producers have the will to cut production sufficiently to plug the massive supply/demand gap amid the prevailing lockdowns across many global economies.

The IMF forecasts that the world economy will see its sharpest contraction since the 1930s depression, which by now will not surprise many, while a study from the Harvard School of Public Health highlighted that the return to normal may be a long road, saying (of the US) that “intermittent distancing may be required into 2020 unless critical care capacity is increased substantially or a treatment of vaccine becomes available.”

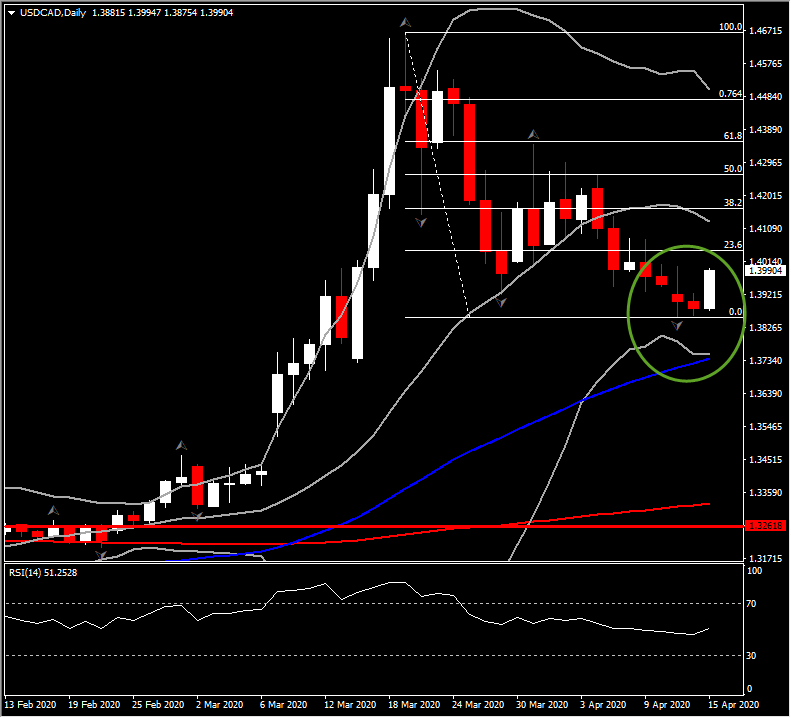

Let’s flip back to the Canadian Dollar:the outlook so far for USDCAD has been negative, however a close today above 1.3990 could form a morning star pattern which is a bullish sign suggesting a potential reversal of the asset.

Elsewhere, the Dollar and Yen have posted moderate gains versus the Euro and most other currencies. EURUSD drifted to a low at 1.0923. The pair continues to reject the 50-day SMA and the 61.8% retracement level set from the upleg at the end of March. The overall picture remains positive as long as it sustains a move above the confluence of 50% Fib. level and 20-day SMA, at 1.0891. Intraday however the asset is oversold, hence a consolidation or a correction might follow since the asset closed the hour outside Bollinger bands. Further decline could be triggered if the asset breaks the 1.0925 level (S1).

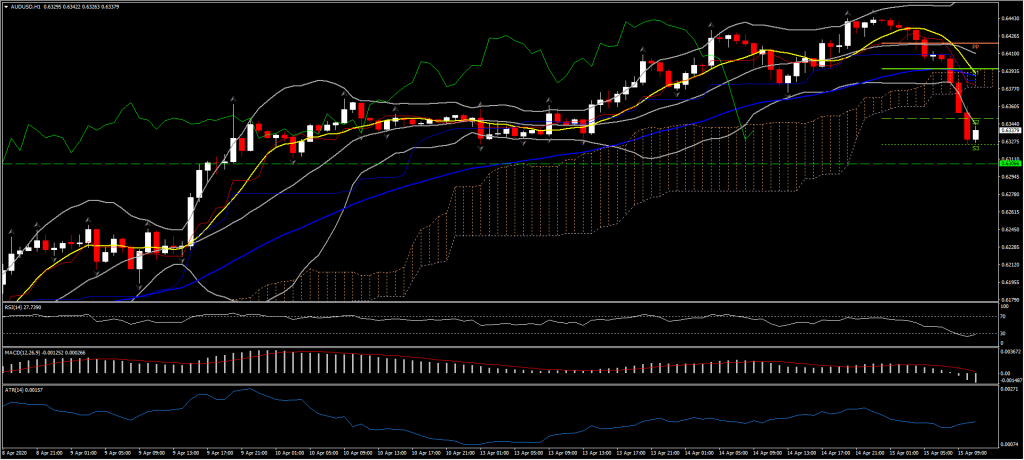

Additionally, the biggest movers have been AUDUSD, NZDUSD, AUDJPY and NZDJPY, which have all racked up losses of well over 1%. AUDUSD, after a run of 7 consecutive days highs, has printed a 2-day low at 0.6325, reaching the S3 of the day. The pair still remains up by over 15% from the 17-year low that was printed on March 19th. However, intraday it turned below all moving averages and crossed below Ichimoku cloud, and with three black crows and momentum indicators negatively configured suggesting further bearish bias, we might see the asset extending its move further southwards.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.