Oil currencies have come under pressure concomitantly with crude prices hitting 21-year lows, while most Dollar pairings and associated crosses have been trading in comparatively narrow ranges amid a backdrop of sputtering stock markets.

Most of the main Asian equity indices are showing losses of varying degrees, though Chinese markets bucked the trend with moderate gains, while USA500 futures are down 0.4%.

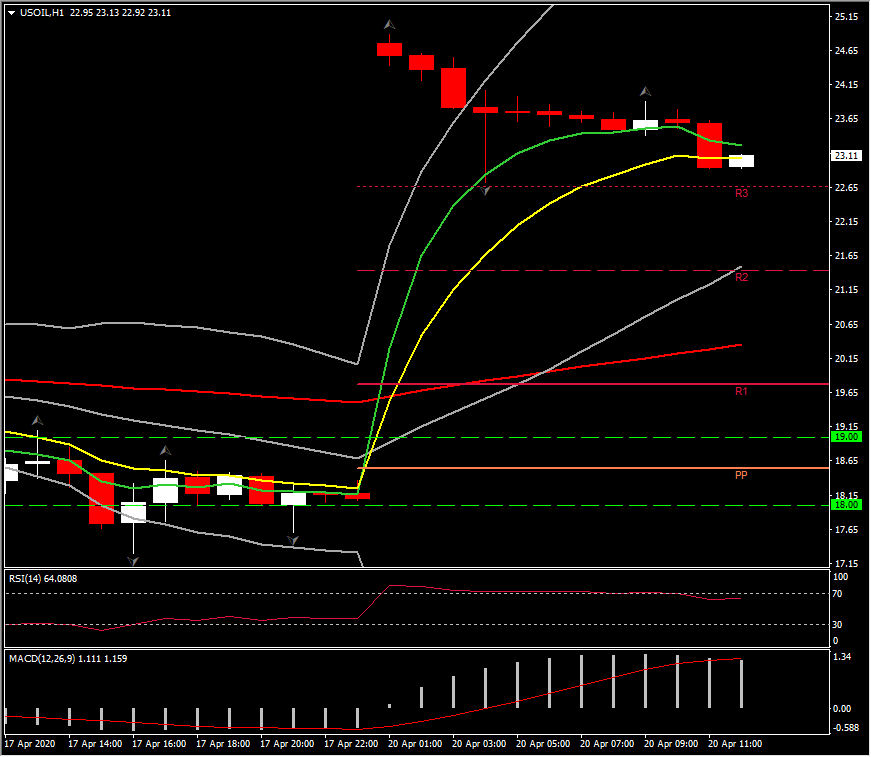

The Baker-Hughes weekly rig count on Friday saw 66 oil rigs shuttered in the latest reporting week, bringing the total down to 438, the lowest seen since late 2016. This marked the fifth straight week of declines, with the count falling 36% over that period. WTI crude prices shrugged off the report with the May contract of WTI crude oil futures showing an intraday loss of 20% in hitting a low at $14.47, which is the lowest WTI benchmark prices have traded since March 1999. May futures expire tomorrow, while the June contract posted a low at $23.75. The Oxford Institute for Energy forecast that China’s annual demand for Oil will fall by between 100k and 250k barrels per day in what would be the first contraction since records began in 1990, which chimes with OPEC saying last week that global oil demand is set to fall to just 20 mln barrels per day, the lowest since 1989.

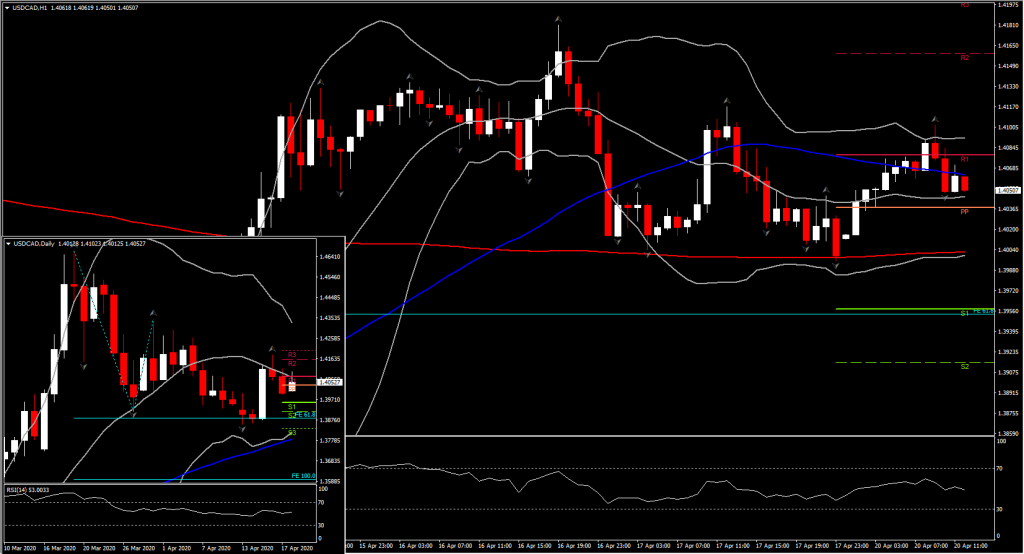

In forex markets, the oil-correlating Canadian dollar is the weakest of the main currencies, off lows at the time of writing but still showing a loss of 0.6% to the US Dollar, which marginally registers as the firmest currency on the day.

USDCAD printed a high at 1.4103, up on Friday’s low at 1.3998. So far it remains in the mid range at 1.4050. Given the massive demand/supply imbalance in oil markets, and after the IEA said last week in its monthly report, that there is “no feasible agreement that could cut supply by enough to offset such near-term demand losses,” theoretically USDCAD could sustain a bullish view, as CAD is positively correlated to Oil price. Technically however, it remains for the 10th day in a row below the 20-day SMA, with momentum indicators presenting that the asset has entered a ranging market. Hence for the overall outlook to turn positive, USDCAD should sustain a move above 1.4100- 1.4135 (Friday’s peak).

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.