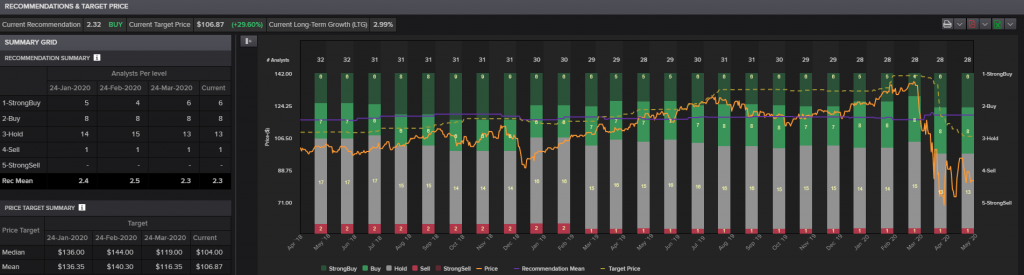

American Express’ first Quarter earnings for 2020 will be reported before the US Market opens today. The consensus recommendation for the company is “strongly neutral” corresponding to the majority of the consensus recommendation for the Online Services peer group , from 28 Analysts .

Figure 1: Data Provider: Data is provided by Reuters

This neutral stance is mainly on the uncertainty of whether the COVID-19 lockdown and hence the limited consumer spending will have negatively or positively impacted the company’s Q1 report. On the one hand the lockdown could see a spike in online transactions, but on the other hand, the lockdown also restricted consumer spending as well.

The majority of the market is expecting that the company will be negatively impacted since despite the increase in online transactions, the business closures have significantly impacted the sales figures globally.

The survey responses in March and April won’t be useful for forecasting the sales figures, as sales data will mostly reflect the impact of mandated closures. Both confidence and sales will likely fall in March and April because of the breadth of business closures, which is more of a drop in supply than demand.

If we emphasize the US figures, retail sales plunged -8.7% in March leaving a huge sales pull-back into the end of Q1 that reflected the market’s worst fears. All of the components posted bigger gyrations than we had assumed in March, in divergent directions. The big headline drop reflected a huge decline for auto dealer sales, service station sales, furniture sales, food services and drinking place sales and clothing store sales plunged a whopping -50.5%. Any upside surprises were only for food store sales and for building material sales.

The company is expected to report $1.43 earnings per share this quarter, according to Reuters (EIKON). This represents a yearly change of -14.9% y/y from Q1 2019. The Revenues number is projected to hit $10.65 billion. In the same period of last year, Amex said it had $2.01 in EPS and $10.49 billion in revenue.

According to Zacks Equity Research team: ” The company’s one of the largest strategic partners is Delta Air Lines, along with which it issues cards under cobrand arrangements. Delta and Delta cobrand portfolio represented nearly 8% of the company’s worldwide billed and approximately 22% of its worldwide Card Member loans as of Dec 31, 2019. The Delta cobrand portfolio generates fee revenues and interest income from Card Members and discount revenues from Delta and other merchants for spending on Delta cobrand cards. Given that Delta Airlines cut capacity of several flights during the quarter to be reported, revenues for American Express are expected to have taken a hit.”

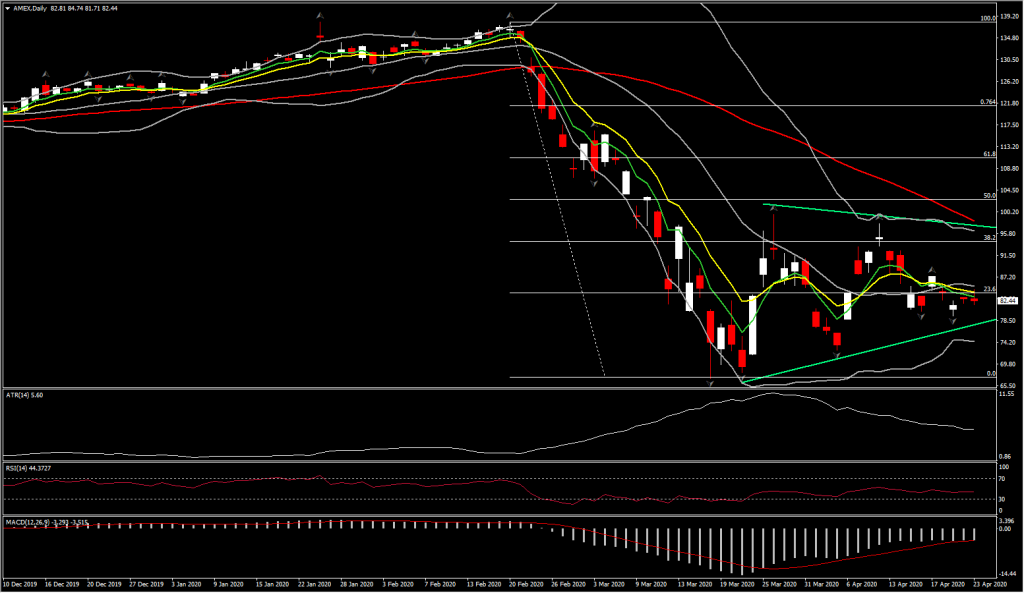

A better than expected financial report today could shift the attention to the upside however based on the global recession fear, while any upside move could be limited. The share price remains under a lot of pressure, since it is traded below the 23.6% Fibonacci level set from the downleg from the $138 high.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.