Pfizer Inc., the largest pharmaceutical company in the world, is a Biopharmaceuticals Group comprising six business units — Oncology, Inflammation & Immunology, Rare Disease, Hospital, Vaccines, and Internal Medicine. It is expected to report earnings of the first quarter of the year tomorrow 28 April, before the market opens. The report will be for the fiscal Quarter ending Mar 2020. According to Zacks Investment Research, based on 3 analysts’ forecasts, the consensus EPS forecast for the quarter is $0.71. The reported EPS for the same quarter last year was $0.85.

Let’s take a look at why we expect these numbers

2020 will be a memorable year, for a number of reasons. In the stock market, the first quarter was extremely volatile, with stocks posting record highs initially. However, in March, panic caused a big sell off in stocks due to the virus outbreak.

Let’s turn to Pfizer though. The company saw its share price rise to $41in January, however the virus changed everything, even though an epidemic is theoretically supposed to help pharmaceutical companies to sell more and raise their stock prices. But not COVID-19!

COVID-19 is a new virus with no vaccine or pill, which could turn the current threat into an amazing opportunity for companies like Pfizer.

“BioNTech SE (NASDAQ: BNTX, “BioNTech” or “the Company”) and Pfizer Inc. (NYSE: PFE), have announced that the German regulatory authority, the Paul-Ehrlich-Institut, has approved the Phase 1/2 clinical trial for BioNTech’s BNT162 vaccine program to prevent COVID-19 infection. BioNTech and Pfizer are jointly developing BNT162. The trial is the first clinical trial of a COVID-19 vaccine candidate to start in Germany and is part of a global development program. Pfizer and BioNTech will also conduct trials for BNT162 in the United States upon regulatory approval, which is expected shortly.” (GLOBE NEWSWIRE)

For companies like Pfizer, this is the opportunity to recover its lost share price, which after its all-time high of December 2018 ($47), tested its more than 5 years low of $27.80 in March 2020. This is, of course, only if their current project of a COVID-19 vaccine is approved and is actually proven to be a vaccine to combat the pandemic.

According to the Zacks Consensus Estimate the sale of Ibrance (worldwide) and Eliquis for Q1 2020 for Pfizer is expected at $1.32 billion and $1.22 billion, respectively. The Zacks Consensus Estimate for Inlyta and Xeljanz’s sales is pegged at $175 million and $515 million, respectively.

For tomorrow’s report, investors will also be looking at Pfizer’s new brands such as Vyndaqel/Vyndamax, Braftovi, Mektovi and new oncology biosimilars (Trazimera, Zirabev, and Ruxience), which are likely to have brought additional revenue to the company.

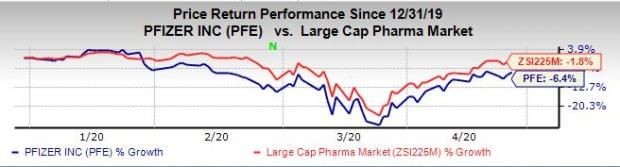

Pfizer’s stocks have lost more than 6.4% during the past two months, while the overall decline of this industry was just 1.8% (check out the below Figure from Zacks).

Summary

Pfizer has a Zacks Rank of #3, which means a Hold recommendation. Looking at the pharmaceutical industry can also confirm that following the coronavirus pandemic many countries will start investing more in researchers and pharmacy products, as they may count this field part of the Defense Industry, defending biological attacks.

Technical overview – Daily chart

In the Daily chart, the price moved back above the main MAs. The OBV trend line turned to bullish, which RSI at 62 also confirmed. While the charts are showing the bullish movement here, the market volume also started rising to stay in same direction of the price movement.

$34 is the key support level, which is a key level, since if we look back, it is the middle range of 2017, and 2018, before price moved to its all-time high and restarted the uptrend in March and April. After 8 months of a decline downtrend, bears stopped there and the uptrend started again.

On the other hand, $38.50, 78.6% of Fibo from its February high to its 6 years low on 23 March, is the key resistance at the moment. Above that $39.40 and $40.90 are second and third resistance.

Click here to access the HotForex Economic Calendar

Ahura Chalki

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.