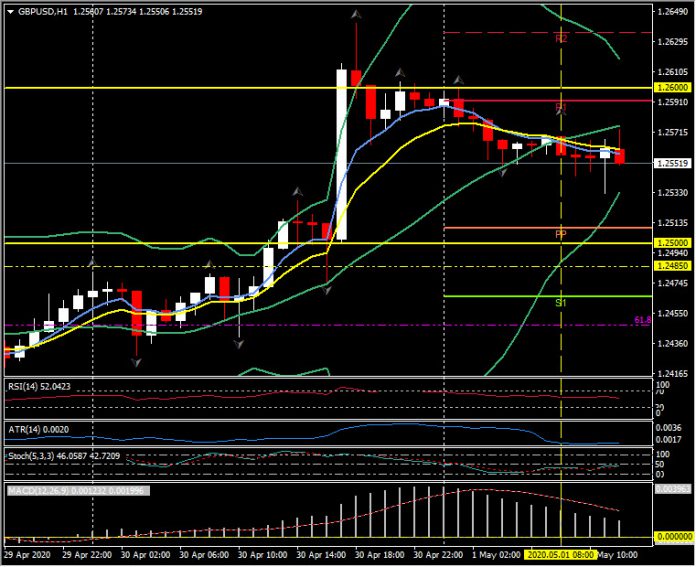

GBPUSD, H1

The UK’s final April manufacturing PMI was revised lower to 32.6 from 32.9, tumbling from 47.8 in March. The final April versions of the services and composite PMI readings will be released next week, along with the April construction PMI report.

The UK’s preliminary April composite PMI plummeted to a reading of just 12.9, down from 36.0 in March. As has been seen in other countries, the service sector drop was eye watering, diving to 12.3 from 34.5, with April being first month of data to fully capture the true impact of the coronavirus/lockdown. The scale of decline in the preliminary composite reading was, of course, the biggest since records began in 1998, reflecting the extent of business mothballing. 81% of service providers and 75% of manufacturers reported a fall in business activity during April, which was overwhelming attributed to the pandemic. In the manufacturing realm, the small minority of businesses reporting output growth were involved in medical supply chains or producers of food or drink. Many sub-components fell by record amounts, but while staffing levels dropped there were numerous reports that the fall reflected the use of the government scheme to furlough workers. On ray of light came from business optimism for the year ahead, which lifted off its record low that was seen in March, and which likely reflected expectations for a phased reopening of the economy.

Sterling weakened on the news with, Cable dipping to 1.2532, EURGBP moved up to 0.8745 and GBPJPY tested below 134.00, before recovering.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.