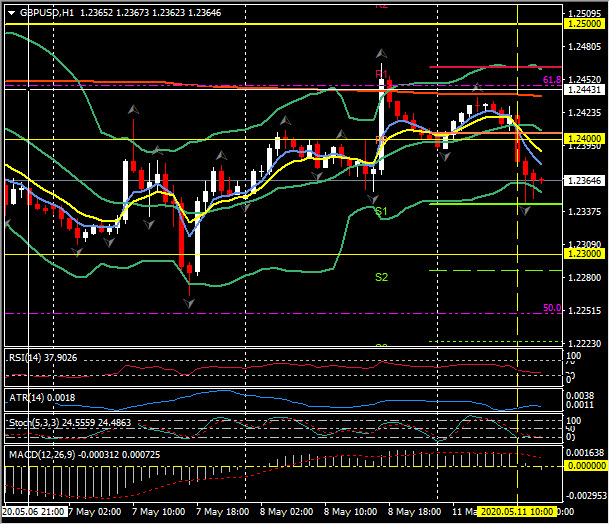

GBPUSD, H1

Cable has ebbed to an intraday low at 1.2344, driven by a moderate bid in the Dollar and rumored splits within the UK cabinet surrounding “stay alert” policy. This puts the pairing back in the lower reaches of the range that’s been prevailing since early April, which in turn marks a consolidation of the gains seen out of the 35-year low at 1.1409 that was seen in mid-March. Sterling has become apt to correlate with global stock market direction so far in the era of the pandemic crisis. The UK has proved vulnerable to the pandemic, both economically, due to the nation’s open economy, current account deficit, and outsized financial sector, and in terms of contagion, as a consequence of the massive international hub that is London, which served as a gateway for the coronavirus to spread throughout the UK. The UK currently has just over 219k confirmed cases, which is the fourth highest national total in the world (after the US, Spain and Russia), and the second highest Covid-19 deaths (at nearly 32k). Despite the high totals, reported cases are now in decline and the UK has today commenced its first baby-step to reopening its economy, with non-essential manufacturing now reopening. However, the government has come under criticism and there are reports of splits within Cabinet over the new “stay alert” strategy and strap line¹. EURGBP has moved to 0.8758 intraday highs and holds R1 at 0.8750 with GBPJPY dipping to 132.50’s following a breach of 133.00 earlier.

The UK and EU will commence with the next round of trade talks today. The British government has continued to insist that there will be no delay in the UK’s end-of-year departure from its Brexit transition membership of the EU’s customs union and single market. The UK has until July 1st to commit to this, so the pressure is on negotiators. Markets will continue to factor in a risk that the UK leaves the EU at the end of the year without a new trade deal, as many analysts see there is insufficient time to negotiate a new deal, even though the two sides are starting from perfect equivalence. Leaving the single market (which includes 40 free trade deals with global economies) without a new deal would mean a large portion of the UK’s trade would switch to much less favourable WTO terms and conditions.

¹https://www.bbc.com/news/uk-politics-52611466

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.