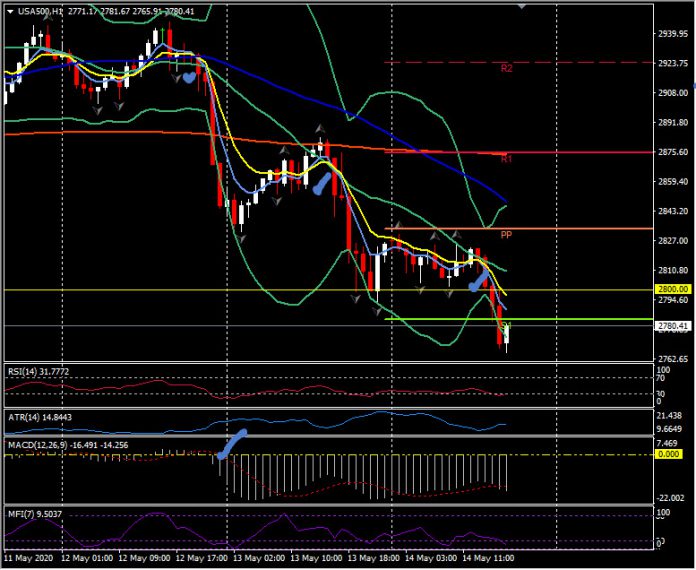

USA500, H1

The -195k initial claims drop to a higher than expected 2,981k in the second week of May only modestly extended the -670k decline to 3,176k (was 3,169k), leaving a stubbornly slow six-week pull-back from the 6,867k record-high at the end of March. Continuing claims were more encouraging, with a 456k rise to a leaner than expected 22,833k, so fewer people are receiving jobless benefits than assumed. Next week’s continuing claims will likely fall, as individuals are pulled out of the jobless pool with store re-openings. We’ll peg next week’s numbers at 2,000k for initial claims, and 22,600k for continuing claims. Claims are averaging 3,024k thus far in May, after averages of 4,572k in April, 3,048k in March, 214k in February, and a cycle-low 211k in January. Next week’s BLS survey week reading will undershoot the 4,442k April figure, versus prior survey week readings of 282k in March, 215k in February and 220k in January. The May nonfarm payroll estimate has been trimmed to 2,800k, following the -20,500k drop in April. The factory payroll estimate was lowered to 300k with delays in re-openings for the “big three” automakers to next week. The important week for the May jobs report is the one ending this Saturday, which is the BLS survey week. We’ve seen slow gains in daily foot traffic that have been bigger in Texas, and a big rebound in the MBA purchase index.

Equities continue under pressure in Europe and US markets have opened lower, down on average -1.7%. The USA500 has moved under the psychological 2,800 for a third day of losses. A close below this key level would be the first time in 15 trading days.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.