Positive headlines on an experimental vaccine and upbeat comments from Fed Chair Powell helped to boost investor confidence yesterday and so far today, with bond markets under pressure amid a backdrop of rallying global stock markets. American biotech Moderna announced further progress in its development of a vaccine for the coronavirus. Powell’s speech today will be in focus, but there are also lingering concerns about escalating tensions between the US and China.

Reuters reported that Nasdaq is set to unveil new rules on initial public offerings that are expected to make is more difficult for some Chinese companies to list on the exchange. Meanwhile China’s announcement that it will impose 80% tariff on barley imports from Australia also raised fears of new trade tensions.

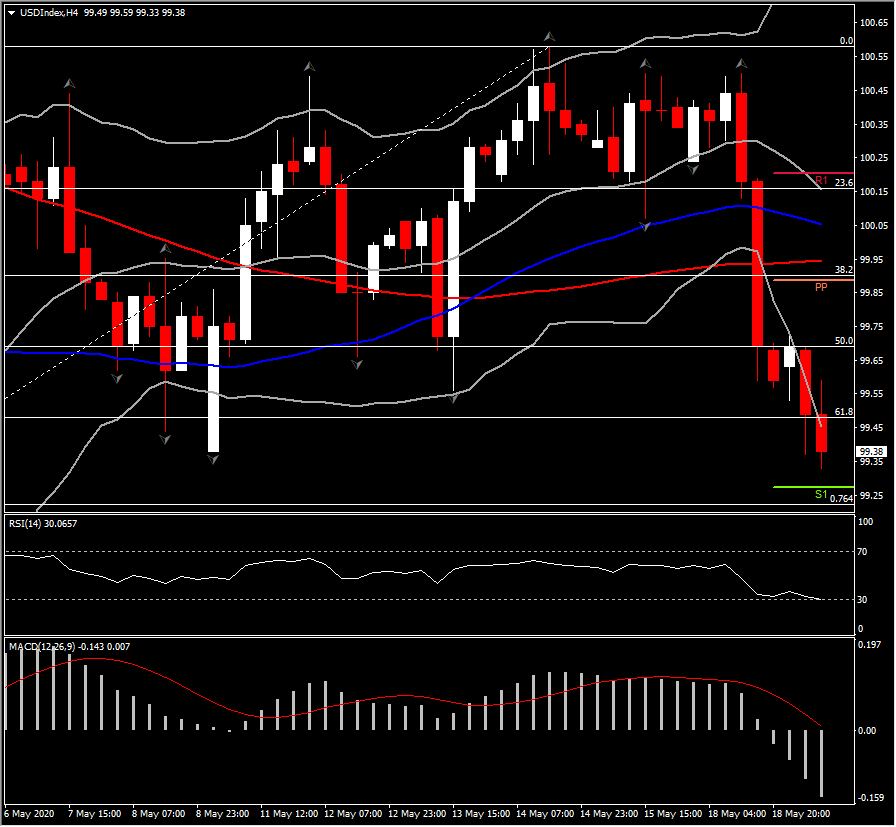

The Dollar has remained soft amid a backdrop of rallying global stock markets, which are being buoyed by reopening economies, positive news on the development of a vaccine for the SARS Cov-2 coronavirus, and fresh pledges for further stimulus if necessary from the Fed, ECB and other central banks, factors which are managing to outweigh concerns about the ratcheting-up tensions between the US and China, and Australia and China. The narrow trade-weighted USDIndex fell to a 11-day low of 99.37, extending the decline from levels near 100.50 that has been seen over the last day. Intraday, momentum indicators are negatively configured with MACD turning negative and RSI at 30, while lower Bollinger bands line extends lower suggesting an increasing negative bias. Next Support for USDIndex could be seen at 99.25 and 99.00.

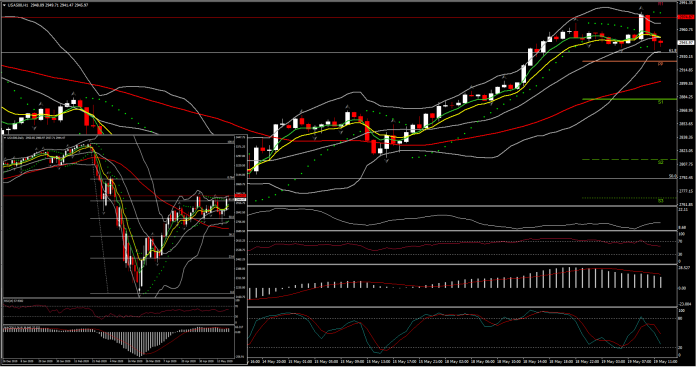

In contrast with USD, we have seen US futures outperforming since yesterday. However on European open, the US future changed slightly and now they are narrowly mixed. USA500 after breaking 2-month highs at $2,975, it turned 40 points lower. However positive momentum looks to be sustained for the time being despite the decline in European session, since yesterday’s strong bullish candle strengthen the positive bias for the asset. Hence if this is sustained, could provide in the near future a stronger signal with the potential of a return back to pre-crisis levels.

Currently, from the technical side, the RSI sustains a move above 50 suggesting that the so far pullback could be a correction of the OB asset. MACD lines turned slightly below signal line however they hold into the positive territory whilst Stochastics dipped closed to OS area. If the latter turn away from OS area it could confirm that the latest pullback its just a nearterm correction on yesterday’s 3% rally. Given the strength of these moves, a breakout above 2,990 is significant since it could turn the attention initially to 3,110 levels and later on to 3,400 area. To the flipside, only a break below 20-day SMA could signal the reversal of positive outlook for USA500.

As stated earlier, today all eyes have turn to Fed chair Powell testimony on COVID-19. Today’s testimony could give another boost to equity market.

Fed Chair Powell testifies before the Senate Banking Committee today. His more positive outlook on the economy from Sunday’s “60 Minutes” interview helped light a fuse under stocks today, and we suspect he’ll stick with that view before the Senate, while also stressing the need for fiscal action. Perhaps he was disappointed with the “downbeat” characterizations of his comments last Wednesday and sought to alter that a bit, noting he sees the economy picking up as soon as next quarter, though uncertainties over the coronavirus’ path and possible treatments could delay a full recovery until well into 2021. He acknowledged that GDP could shrink as much as -20% to -30%, with unemployment perhaps peaking around 20% to 25%, but doesn’t another Great Depression is a likely outcome. Resonating most for the markets, however, was his comment that “in the long run, and even in the medium run, you wouldn’t want to bet against the American economy. This economy will recover.”

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.