XAUUSD, H4 – Gold price continued to fall for the third day as the market began to return to accept more risks this week. However, the Asian stock market is not clear today, with Nikkei +0.70% and the Thai morning SET closed -0.06% while the Hang Seng dropped more than -1% due to protests in Hong Kong regarding a new security law.

Development of the drug for Covid-19 by the American company Novavax is still unclear. The latest news was the announcement that it was beginning to register participants for the first human vaccine study. Meanwhile, the plan for approval of the Fujigan Avigan drug developed by the Japanese government has been suspended until its security and efficiency is confirmed.

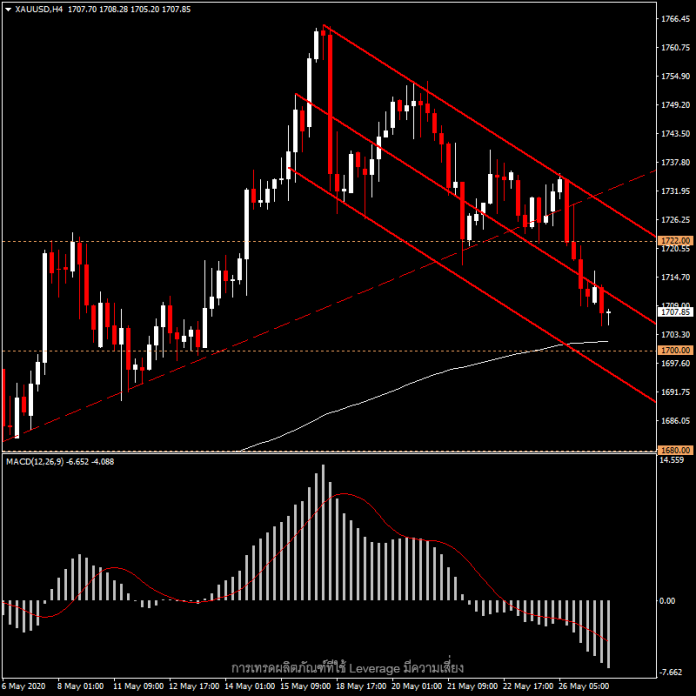

Regarding the price of gold, at this time, there is a technical standpoint that is a fairly clear downtrend. After seeing the bearish divergence in the Daily time frame since the end of last week, followed by yesterday’s break through of the trend line, the price has continued heading down to test the 1,700 psychological support. If this is breached, then the next support zone will be at the 1,680 zone.

In the H4 time frame, price broke through the trend line (dotted line) down to test the key support at the 200-EMA, which is the same zone as the 1,700 psychological support when combined with the unclear Asian stock market view today. This may strengthen the support in this area, which may send gold prices to bounce back to the 1,722 zone again. However, for now we see a downtrend as MACD is still sinking in the negative territory.

Click here to see the economic calendar.

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.