The EUR has lifted on EU recovery fund news, with the European Commission reportedly outlining a compromise proposal that aims to satisfy both the German-Franco position and the so-called “frugal four” (Austria, Sweden, Denmark and the Netherlands).

The EU looks to be moving closer to finalizing massive recovery funds, along with hopes for extra ECB stimulus. According to a Bloomberg report citing a “person familiar with the matter”, the EU is to propose a EUR 750 bln stimulus package. The package will partly be funded via joint debt issuance and include EUR 500 bln to be distributed as grants, with an additional EUR 250 bln available for loans. Not so much a compromise as a combination of the French-German proposal and the proposal of the “frugal four” (Austria, the Netherlands, Sweden and Denmark). Italy has been the hardest hit by Covid-19 and if it gets a sizeable grant to cover part of the recovery costs, it will mean reduced pressure on already strained public finances and also make the ECB’s task much easier.

European stock markets and Eurozone peripheral bonds got a boost from the Bloomberg report, but also on the hopes of additional ECB stimulus after choes comments from ECB President Lagarde earlier today and ECB’s Guindos, who sees the economy shrinking 8-12% this year.

Dovish comments from ECB’s Lagarde, who highlighted the impact of the pandemic on the economy, and Executive Board member Schnabel, who reported that the central bank is ready to expand the PEPP program in size and/or duration added to stimulus hopes and GER30 and UK100 are up 1.7% and 1.5% respectively, after a mixed close in Asia, where a flaring up of protests in Hong Kong and concern over US-China tensions limited risk appetite.

ECB’s Lagarde said that she no longer believes in “mild” slowdown, with the central bank president saying that the economic hit from the virus will likely be between the central bank’s medium and severe scenarios. Lagarde added that the economy will shrink more than during the global financial crisis, with some countries more affected than others.

The comments effectively lay the ground for additional ECB action, with the central bank likely to expand the PEPP program either in June or July.

In the FX market, the Dollar dropped back as risk appetite picked up on news that Japan and the EU are moving closer to finalizing massive recovery funds, losing some of its safe haven premium, in turn giving EURUSD a further underpinning.

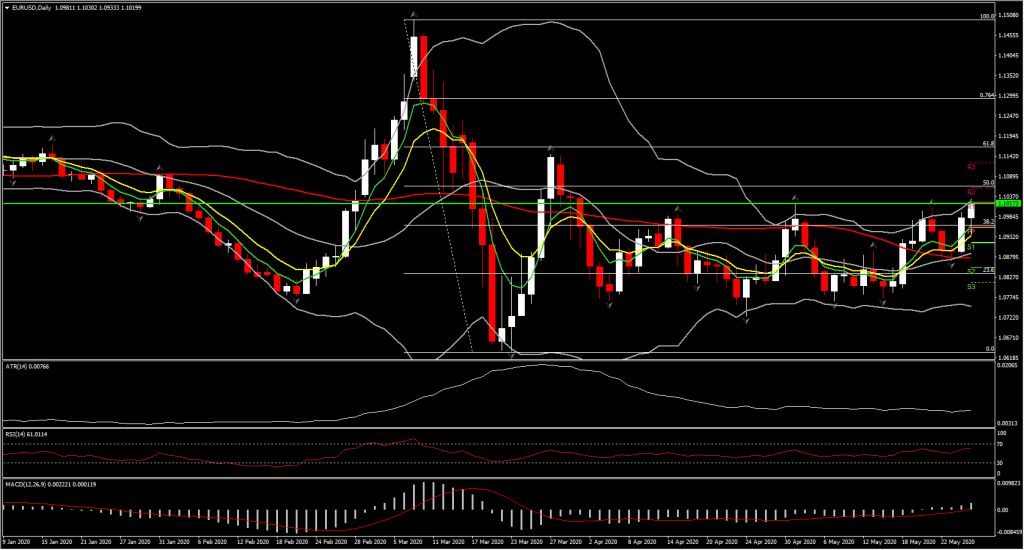

EURUSD has rallied and broken above 1.1000, posting a high so far at 1.1030, which is the loftiest level seen since April 1st. A low was left at 1.0935. The EUR is up against other currencies, too, showing respective 0.3% and 0.5% advances versus the Pound and Yen, for instance. EURUSD continues to trade in a broad consolidation range near the halfway mark of the volatile range that was seen during the height of the global market panic in March, which was marked by 1.0637 on the downside and 1.1494 on the upside. Despite the fresh highs today, the pair continues to lack sustained directional bias in the medium and long term picture. There is little divergence in central bank policy currently, with both the ECB and the Fed pursuing aggressively accommodative policy, with both Europe and the US facing significant economic headwinds from virus-containing lockdown measures. Both are amid the early stages of reopening from lockdowns.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.