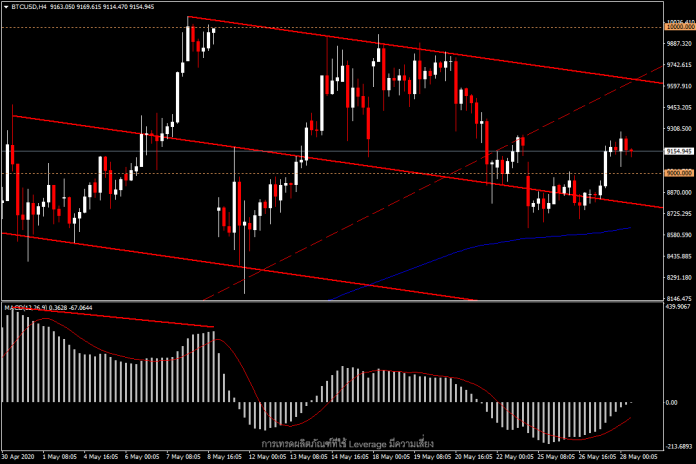

BTCUSD, H4 – Clearly, the outbreak of Covid-19 was able to push Bitcoin prices back up to test the 10,000 price level twice this month. The fact that the asset failed to pass the particular level explains the price behavior of cryptocurrencies, in accordance with the principle of more safe haven groups that teased investors’ sentiment towards the overall picture of the economy.

After the announcement of Libra, which has gained momentum from the US government, Facebook has recently rebranded Libra’s digital wallet app from its former name Calibra to Novi. Facebook also hired former FinCEN director Robert Werner to be a consultant.

This news may boost the sentiment in cryptocurrencies in the market. Meanwhile, despite the fact that China has begun to experiment with digital Yuan instead of paper money in 4 cities, including Chengdu, Suzhou, Shenzhen and Song An, the Chinese authorities do not have a clear schedule for launch yet .It is expected that it will be during the 2022 Winter Olympics. However, it is expected that China may announce the launch of the Yuan faster once the Covid-19 crisis is over.

Analysts predict that the goal of launching the digital Yuan is not just to use instead of paper money, but will be a new battle against the US Dollar as well.

As for the technical perspective, the Bitcoin price failed to rise above the 10,000 level and began to see a downtrend, while the move found support to the 200-period EMA in the 4-hour chart this week. Yesterday the Bitcoin price rebounded from its 200-period EMA and moved above the 9,000 level again.

Earlier a bearish divergence was seen and the price broke below the upwards trend line (dotted line), causing the price to enter the downtrend frame again. Therefore, it is possible that the price of Bitcoin may retest the 8,000 area, which is the lower border area of the channel. However, the MACD is currently cutting up to the positive territory.

Click here to see the economic calendar.

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.