The UK government is disappointed, with Downing Street sources cited by the Guardian saying that the decision by EU fisheries ministers not to change course on their position — to maintain the “status quo”, as the EU’s chief negotiator Barnier put it — has “skewed things late in the process.” As per the UK’s chief Brexit negotiator, David Frost: “Progress remains limited but our talks have been positive in tone,” and, “We are willing to work hard to see whether at least the outline of a balanced agreement, covering all issues, can be reached soon.”

EU’s Barnier sees no progress in Brexit talks and stresses that time is running out. Negotiations failed to advance on the four points the EU considers crucial: fishing, level playing field, government, and law enforcement and security matters. Barnier noted that the UK continues to rule out an extension to the transition period, which can only be agreed to without major legal hurdles until the end of the month. That leaves just 5 months until the October deadline to get an agreement. Anything later would make it difficult to ratify a deal before the end of the transition period in December. Barnier said: “I don’t think we can go on like this forever.” There is some hope for high level in-person talks that are supposed to take place later this month, with no date set yet.

Fishing rights has been the single issue that has taken up more negotiating time than any other, reportedly, over the last week of talks. Hence, London is frustrated by Barnier’s inability, thus far, to convince various member states to look for a compromise.

The UK is insisting, not unreasonably, that it will be an independent coastal state, and that there needs to be a new relationship with the EU with regard to fishing, pointing to Norway as a working example. The EU, on the other hand, wants to emulate the common fisheries policy (CFP), under which fishing quotas are agreed at an annual negotiation.This is a major issue for the UK which ran large in the pro-Brexit campaign. The UK government, for instance, points out that the scheme has led to France having 84% of the cod quota in the English Channel.

The EU is now expecting the talks to drag on until October, regardless of whether the UK asks for an extension of its post-Brexit transitory access to the single market (which it has to decide on by July 1st). An agreement has to be on the table by October at the latest, in order for it to be ratified before the end of the transition period and so far the risk of a no-deal end to current arrangements remains firmly on the table.

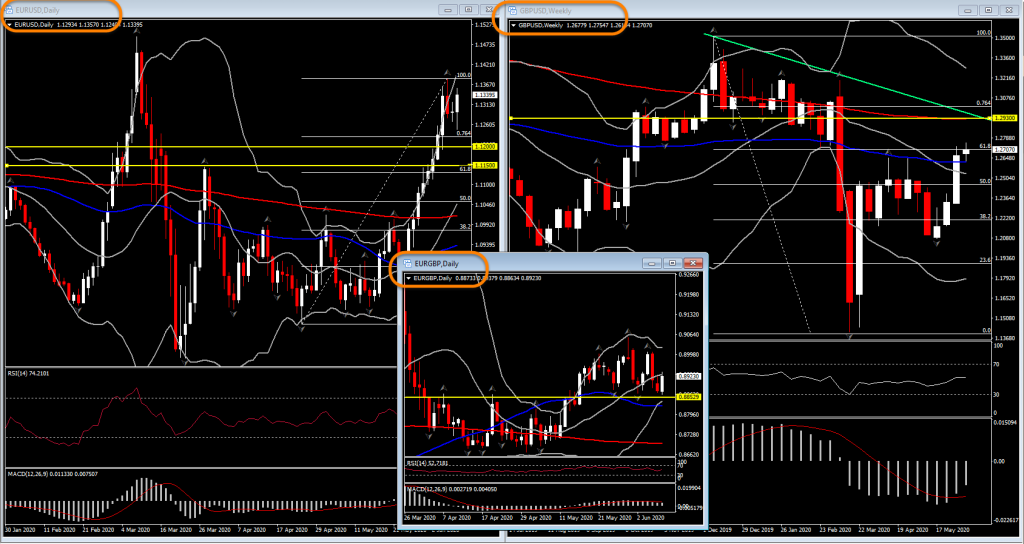

The Pound has nudged moderately lower versus the Dollar and Euro on the news of the EU’s intransigence on fisheries. The backdrop of sliding stock markets in Europe has weighed on the pound, which has established a pandemic-era proclivity to underperform its main currency peers during risk-off periods. Attention will remain on the UK-EU trade negotiation front. Prime Minister Johnson will reportedly meet with European Commission President von der Leyen later this month. Unless there is a breakthrough in trade negotiations, the Pound’s upside potential is likely to remain limited in the medium term with strong Resistance at 1.2930-1.3000.

Despite the progress, the BoE last week reportedly warned UK banks to be ready for a no-deal Brexit. This came in light of the UK government having been playing hard ball, saying that it is quite prepared to walk away without a deal, even though this would imperil the majority of UK trade to much-less-favourable WTO terms from January 1st 2021.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.