USOIL is sharply lower, adding to the losses seen on Wall Street yesterday that came in the wake of the FOMC’s delivery of a rather gloomy outlook. Indeed, the FOMC “is not even thinking about thinking about raising rates,” said Fed Chair Powell, and the “dots” show a near 0% through 2022. Additionally, there are also rising concerns that a second wave of coronavirus is hitting as overall infections have now topped 2 mln, with Texas seeing its highest one-day total.

USOIL showed a decline of over 8% today, at $36.15. The drift started yesterday after another record build-up in US crude inventories and the US Federal Reserve’s projections that the world’s biggest economy would shrink 6.5% this year.

Like in the case of the ECB, part of the FOMC’s pessimistic take was likely designed to justify very expansionary monetary policies, but most central banks have indeed been forced to revise down projections and the comments also acted as a reminder that the recovery from virus-related disruptions will be slower than the sharp rebound in some stock markets seems to imply. At the same time, stimulus measures have been front loaded in many areas and central banks are less and less likely to add to what is already there.

Still, it is clear that the recovery will take some time and that the contraction is not over in many countries.

Hence both UKOIL and USOIL set their worst daily drop since April 27.

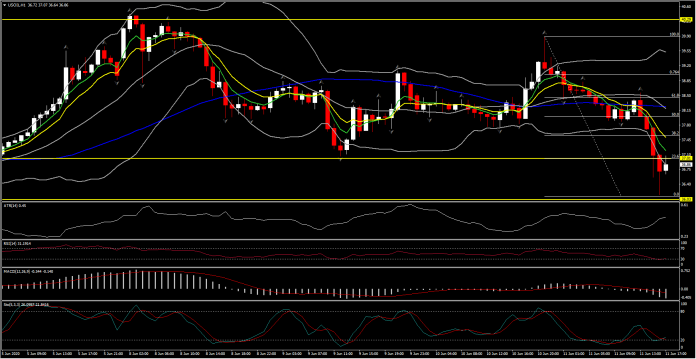

As USOIL has slipped back from Monday’s high of $40.42 to the $36 area this week, a near term reversal has threatened again. So far, the bulls have fought hard this week to leave the overall outlook positive as despite the near term weakness, the 20-day SMA remains untouched. Intraday now, the market had a sharp trend lower today and is now testing yesterday’s low level and $36-37 area. Intraday Momentum indicators turned negative with RSI ranging at 30 and MACD extending lower below neutral zone, while Stochastics turned slightly above OS, suggesting a potential correction in the next few hours. As the price support at $36 this week has already been broken, the bears could be looking to kick in again. If the asset sustains a move below $37, it will bring the $36/$35 breakout support back into play. Resistance is at $37.50 initially

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.