GBPUSD,H1

The Pound has lost ground to the outperforming Dollar and Yen and some of its main peers, including the Euro, amid the risk-off backdrop, although has still gained against the underperforming Australian and New Zealand Dollars. The UK currency’s pandemic-era proclivity to correlate with global stock market direction is once again in evidence. On the UK-EU trade negotiation front, the EU’s chief negotiator, Barnier, yesterday reiterated the EU’s stance, that its post-Brexit relationship with the UK cannot be the same as in the cases of the EU and Canada, or the EU and Japan, given the UK’s proximity and the consequent necessity to come up with an acceptable deal on fisheries and a level playing field (common rules and standards). This implies that there has been little traction in negotiations, with London demanding much more generous access to fisheries than under EU proposals (which closely mimic the prevailing status quo) and not to be tied to EU regulations (which, so the UK government argues, would impede the UK’s freedom to strike trade deals with other major economies and trading blocs). The UK data calendar this week is quiet until tomorrow (Friday June 12), when April GDP and second-estimate Q3 GDP data is published, alongside April production and trade figures.

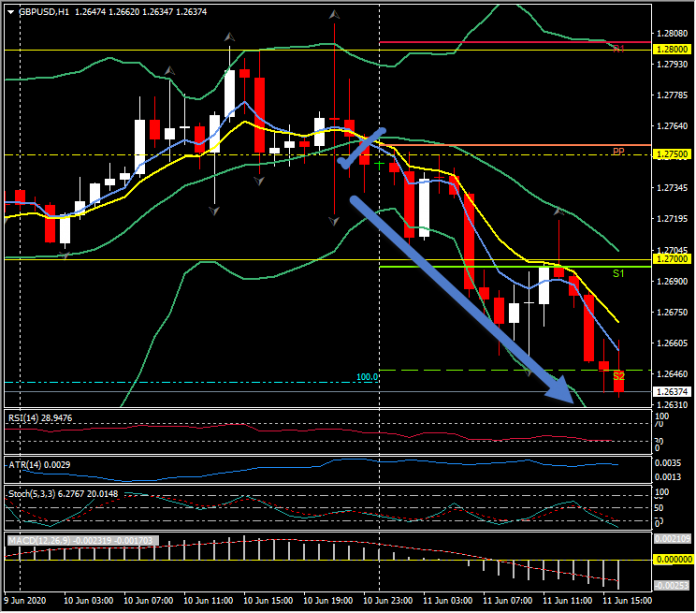

Cable, having rejected 1.2800 post FOMC yesterday, has tracked significantly lower today. It breached S1 at 1.2700 and the 200-day moving average at 1.2670 and is now testing below S2 (1.2650) to touch 1.2630, following the US data. Today’s US PPI final demand bounced 0.4% in May, with the core rate dipping -0.1% and the US initial jobless claims fell -355,000 to 1,542,000 in the week ended June 6 after sliding -226,000 to 1,897,000 previously. This is the 10th straight week of declines for initial claims since surging to a record 6,867,000 in the week ended March 27. Though progress is being made, it’s slow and US jobless levels remain very high.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.