USDCAD, H1

US import prices bounced 1.0% in May, with export prices edging up 0.5%. These follow respective declines of -2.6% and -3.3%. On a 12-month basis, import prices were down -6.0% y/y versus -6.8% y/y, and export prices were -6.0% y/y versus -6.8% y/y (was -7.0% y/y). As for imports, petroleum prices climbed 20.5% (a record advance) after diving -31.0% (was -33.0%) in April. Ex-petroleum, import prices rose 0.1% from -0.4% (was -0.5%). Food prices jumped 2.2% after dropping -1.6% (was -1.3%). And industrial supplies prices climbed back with a 4.6% gain from -12.3%. Import prices with Canada surged 3.6% after April’s -9.6% (was -10.2%) drop, and were unchanged with China versus a 0.1% prior gain. Export prices excluded agriculture increased 0.6% from -3.3%, as agricultural prices slipped -0.5% from -3.1%.

Canada’s capacity use rate fell to 79.8% in Q1 from 81.4% in Q4 (revised from 81.2%). The decline in the capacity use rate was driven by the business shutdowns that were in turn due to the lockdowns that began in March. A pull-back in manufacturing capacity use to 74.4% from 78.5% led the declines in total capacity use. Notably, the capacity use rate in the mining, quarrying and oil and gas sector was unchanged at 77.8%, with oil and gas capacity slipping to 81.5% from 81.8% — a hefty decline in oil and gas capacity use is in store for Q2 however. Separately, the debt to income ratio rose to a fresh record 176.9% in Q1 from 175.6% in Q4, as credit growth continued to move higher while income growth lagged. We expect further growth in this ratio this year as incomes stagnate/contract amid the shuttering of the economy and slow recovery.

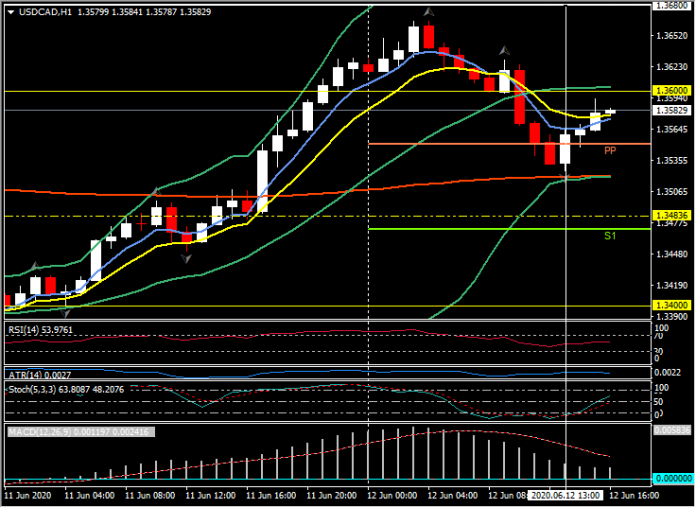

USDCAD was little moved following the data, where US import prices were firmer, Canadian utilization slipped below expectations and Oil markets showed some recovery from yesterday’s significant sell-off. Today, the pair have moved down from the tweezer top at 1.3665 to the lower Bollinger band and 200-hr support at 1.3520, then a move higher to breach the daily pivot at 1.3550 and move to 1.3570.

USOil recovered some from its one-week low of $34.49 seen Thursday, with losses driven by risk-off conditions, as fears of a second virus wave spiked, leaving recovery speed in doubt. The July contract has since recovered to $36.75 highs, though remains well below Monday’s three-month high of $40.44. The WSJ (paywall) reported last weekend that US shale production has been on the rise lately, as existing wells are restarted in response to higher oil prices. The Baker-Hughes oil rig count report for the latest week will be reported this afternoon, perhaps halting the 12 consecutive weeks of well closures. We have seen operating rigs drop to a total of 206 in the US. For comparison, on January 3 of this year, there were 670 oil rigs operating in the US.

US Equity markets have opened positively, with the USA500 trading at 3,080 up 2.5% from the the close yesterday at 3,002.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.