Canada’s CPI slowed to a -0.4% y/y rate in May, contrary to expectations for little change (median +0.1%) after the -0.2% y/y contraction in April. The CPI did expand in May on a month comparable basis, but only by 0.3% that was well short of projections (median +0.7%). Of course there was a wide range of projections for May CPI given the elevated uncertainty over the data as the economy reopened and energy prices snapped higher during the month. Excluding gasoline prices, CPI rose 0.7% y/y in May. Gasoline prices fell -29.8% y/y in May, but were up 16.9% m/m in May after the -15.2% m/m drop in April as prices moved higher in May relative to April. Notably, the core price indexes all slowed, with the the CPI-median easing to 1.9% y/y from 2.0% y/y, the CPI-trim at 1.7% from 1.9% and the CPI-common at 1.4% from 1.5%. Weakness in demand continues to hold sway over prices, but this report does show the varying impacts of the easing in oil price weakness (gasoline prices up on a m/m basis) and emerging pressures from supply disruptions (jump in y/y food prices.) But tame total and core CPI growth remain supportive of the BoC’s all in policy stance.

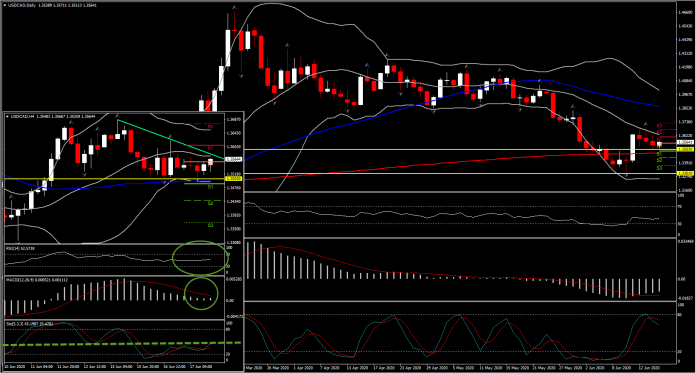

USDCAD rallied modestly following the cooler Canada CPI outcome. The pairing topped at 1.3556, up from 1.3526 at the open. The overnight Asian high was at 1.3570, with the London low coming in at 1.3510. Oil prices remain relatively steady, and have not be much of a driver of CAD direction of late. As OPEC+ continues to withhold supply, while in the US, the EIA reported US production falling to 11.1 mln bpd in early June from 13.1 mln bpd in March. These factors should combine to keep oil prices supported for now and hence Canadian Dollar as well.

Recently positive risk taking levels have limited USDCAD upside so far this week. However the asset sustains a move above the round 1.3500 level and the 200-day moving average at 1.3474 for 5 days in a row. Hence this area provides Support, which if it breaks could suggest the turn of the outlook from neutral to negative and could open the doors initially to the 1.3300 area. The Resistance remains at the 20-day moving average, currently at 1.3630.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.