GBPUSD, H1

The preliminary June UK composite PMI recovered much more than expected, rising to a headline reading of 47.6, which is a four-month peak, lifting markedly from 30.0 in the May headline and extending from April’s record low of 13.8. The median forecast had been for a much more modest rebound to 38.0. The data marks a vast improvement from the lockdown doldrums in April. The 17.6 month-on-month rise in the composite reading was the biggest monthly gain since records began in 1998. The preliminary data were compiled with 85% of the usual monthly responses to the survey. The flash manufacturing PMI jumped back above the 50.0 “boom/bust” threshold, posting at 50.8, which is the best since February — i.e. the best levels since the pandemic and economic lockdowns took effect. The flash services PMI reading came in at 47.0, up strongly from May’s 29.0 reading, and signalling that the sector was only in a moderate pace of contraction. Financial Intermediaries and the Transport and Communication sub-sectors were the best performing service-sector areas, while Hotels, Restaurants and Catering remained, not surprisingly, the weakest services sub-sector. Business confidence also rose to a four-month high.

Needless to say, the reopening of the economy was cited as driving the significant rekindling in economic activity, though there were widespread reports of continued weak underlying demand with cutbacks to spending acting as a drag on overall business. Employment remained weak, although the rate of decline in staffing levels moderated from May. Ahead, further improvement looks likely in July, though the pace of improvement is likely to decline from here. As in other economies, focus will be on the r-rate of new coronavirus infections amid the de-restricting in social and economic activity.

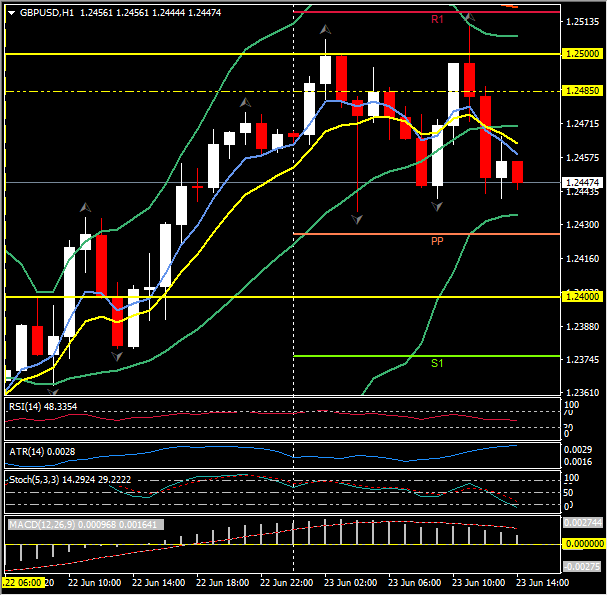

Cable continued its recovery from yesterday’s lows at 1.2340 to finally stall, retrace and then stall again at the key 1.2500. Above the 1.2500 resistance is today’s R1 and the 200-hour moving average at 1.2518. R2 is at 1.2568. Support today is the pivot point at 1.2425, the psychological 1.2400 round number an then S1 at 1.2375.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.