European stock markets are selling off. The better than expected German Ifo reading failed to lift sentiment and after a mixed close in Asia stock markets are now selling off across Europe, with GER30 and UK100 down -1.8% on the day.

Meanwhile US futures have lost their modest overnight gains and are down -0.4 to -0.7% now with fears of a second wave of virus infections and warnings that the lockdowns will have a longer term impact on activity adding to caution.Markets already struggled during the Asian part of the session and Topix and Nikkei closed with losses of -0.4% and -0.07% respectively. The Hang Seng was -0.50% lower at the close, while CSI 300 and ASX managed gained of 0.4% and 0.2%.

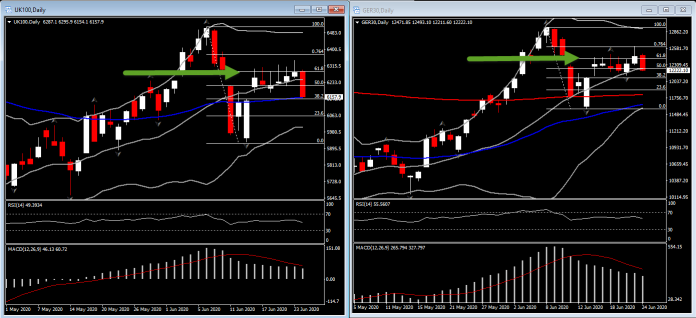

Lets get back to GER30 and UK100 though. The interesting part is that both assets reversed away from the 61.8%-76.4% Fibonacci level set on the June’s downleg. Theoretically, 61.8% is the strongest retracement level, hence that confirms that from the technical side, the asset confirmed that retracement and further decline could find support on lower Fib. levels. However other that the slip away from 61.8% Fib. level, both assets breakout their 20-day SMA, suggesting that if the price action is been sustained by the end of the day below it, then the asset could be seen retesting June 11-15 low territory.

In regards to the EU data now……

German Ifo business confidence jumped to 86.2 in June, from 79.7 in the previous month. The current conditions index nudged higher, but less than hoped and the overall improvement was mainly due to a jump in the future expectations reading, which lifted to 91.4 from 80.4 in may. This is the highest reading since February, although the overall reading still fell back to an average of 80.1 in the second quarter of the year, from 92.6 in the first quarter. The numbers highlight the sharp correction in overall activity that was the result of lockdowns and the diffusion index, which gives the balance of positive and negative answers, still remained firmly in negative territory in June, with pessimists outnumbering optimists across all key sectors. A further indication then that things are improving, but that it will take a long time to overcome the slump. Against that background it remains to be see how many companies will survive and how the labour market will far once official wage support schemes are scaled back.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.