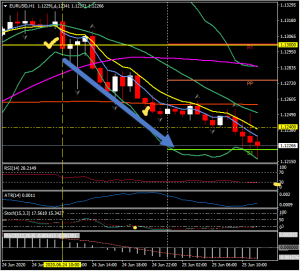

EURUSD, H1

The Dollar has lifted amid a backdrop of tumbling stock markets across the Asia-Pacific region, and with US equity index futures extending lower following the negative close on Wall Street yesterday. Markets in Hong Kong and mainland China have been closed today – the Nikkei 225 closed down 1.22%. European markets have recovered from opening losses with the UK100 up at 6125 from opening lows at 6020 and the GER30 trading at 12,200 up from dips under 12,000 earlier.

Surging coronavirus cases, and related hospitalizations, in the US along with problematic workplace clusters of new infections in many reopening economies, have continued to weigh on investor spirits amid a reality check on the scope for economic recovery while the world remains without a vaccine or effective treatment of Covid-19. News that the governors of New York, New Jersey and Connecticut ordered travellers from eight other states to quarantine on arrival was a particularly sharp reality check, while the Texas governor described a “massive outbreak” and the likelihood of new lockdown measures.

Australia also posted its biggest daily rise in new coronavirus cases since April. Amid this, the IMF downwardly revised its 2020 global GDP forecast to -4.9%, down from the 3% contraction envisaged in April. Australian airline Qantas announced it is laying off a fifth of its workforce, stating that it doesn’t expect sizeable international operations until at least July 2021.

The Trump administration also expanded its list of European goods that qualify for tariffs, as a number of polls also have President Trump trailing the challenger Vice President Biden between 10-14% points nationally.

Amid all this, the narrow trade-weighted USDIndex (DXY) edged out a three-day high at 97.33, while EURUSD concurrently ebbed to a three-day low, at 1.1223 (S1), putting in some further distance from the nine-day peak that was seen at 1.1350 on Tuesday. USDJPY lifted modestly, enough to see the pair carve out an eight-day high at 107.26. Cable poked down to test 1.2400, before recovering and finding resistance at the daily pivot point at 1.2450. AUDUSD posted a three-day low at 0.6848. NZDUSD extended declines seen yesterday following the RBNZ’s dovish policy guidance, printing a three-day low just under 64 cents. With oil prices down, the Canadian Dollar and other oil-correlators traded softer. This floated USDCAD to a 10-day peak at 1.3660. Front-month USOil crude prices fell by over 1% in making a one-week low at $37.12, extending the correction from Tuesday’s 16-week high at $41.63. Gold declined to $1759, down from yesterday’s 8-year high at $1779, before recovering to today’s pivot point at $1765.

Following the ECB minutes later today (11:30 GMT) all eyes will be on the US data releases (12:30 GMT) which includes the final reading of Q1 GDP, the Durable Goods data, Goods trade, Wholesale Inventories and the eagerly awaited Weekly Unemployment claims, which continue to decline and but have consistently been worse than expected over the course of the last 3-months. Will today finally see the data being better than expected? Expectations are for new weekly claims to finally break below 1.5 million and report at 1.32 million, with continuing claims also breaking below the key psychological 20 million at 19.96 million.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.