The ECB minutes yesterday highlighted again that the central bank is very far away from considering exit moves from the pandemic emergency purchase programme (PEPP) program and that means it can continue to ignore the capital key rule for bond purchases and focus very much on keeping spreads in.

With new virus numbers rising in the US, and Germany also reporting new clusters of cases, it is clear that the balance of risks remains tilted to the downside, even if confidence data are improving for now, but hope of additional monetary and fiscal support continues to put a floor under stock markets.

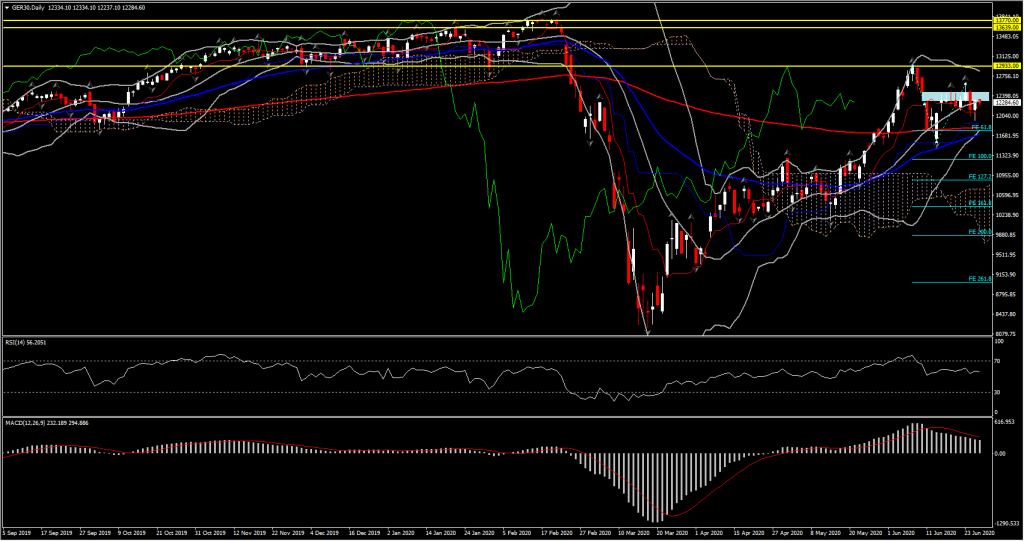

In general, the massive liquidity injections and the prospect of not just national fiscal stimulus, but an EU-wide recovery program that will allow further support have boosted an unprecedented rebound in financial markets. The GER30 is at levels last seen in early March – i.e before lockdowns came in and judging by the jump in German ZEW investor confidence, the crisis is over (highest reading since early 2006). However, although activity may be restarting it will take a long time for the real economy to reach pre-crisis levels – even in Germany, which is expected to fare somewhat better than the other big Eurozone economies.

Cheap money and over-optimistic growth expectations meanwhile could lead to a build up of toxic debt that could pose a real threat to financial stability.

ECB chief economist Lane warned yesterday that the scale of the initial rebound in confidence may not be a good guide for the recovery. The IMF was even more explicit in the latest update to the World Economic Report, saying that markets risk running away with a recovery story, also thanks to the unprecedented stimulus measures that have been announced or are in the pipeline. A look at the real sector, however, suggests that these may help economies to come back from the equally unprecedented contraction in Q2, but that it remains uncertain when GDP will reach pre-crisis levels.

The Confidence data ties in with the strong rebound in stock markets, which in turn is also the result of the ECB’s aggressive stimulus policy that is flooding markets with cash. Together with expected fiscal stimulus, this is helping to underpin confidence in the recovery.

Not surprisingly surveys at company level are somewhat less buoyant, although both Ifo and PMIs also suggested an impressive rebound from the nadir in April. Still, while both manufacturing and services PMIs surprised on the upside in the preliminary readings for June, they still remained below the 50 point no change mark and thus continue to indicate ongoing contraction in both manufacturing and services sentiment.

The real question is what happens further out.

Despite the current uncertainty, what most forecasts agree is that there won’t be a V-shaped recovery in Eurozone, that sees activity springing back to pre-virus levels very quickly.

The implication of this is that:

- The labour market measures that are designed to offer temporary support through a crisis may fall short. Government wage support and flexible agreements with unions allowed companies to scale back production, however if demand fails to return to pre-crisis levels soon many may not make it.

- The German economic model that relies not just on exports but also globalised supply chains may struggle more than others to overcome the crisis.

- Germany’s trade surplus had already started to shrink ahead of covid-19, thanks to a multitude of factors, including trade tensions with the US and the uncertainty over the future trade relationship between the UK and the EU. The risk of a further damaging escalation hangs in the air.

- Bloomberg lays out a month-long public comment period for proposals relating to tariffs relating to USD 3.1 bln worth of exports from France, Germany, Spain and the UK, as a part of long simmering trade tensions between the US and the EU.

- On the UK front there is also no progress in sight.

- Germany is the EU’s largest net contributor and its contributions are set to rise sharply, not just thanks to the rescue measures, but also the UK’s departure from the EU, which removes another net contributor from the equation.

Thanks to the ECB’s generous liquidity provisions there won’t be a shortage of takers, BUT the ECB’s support could also fuel the type of risk taking at financial institutions that lays the ground for an accumulation of toxic debt that could prove a real threat to the financial sector down the line.

Overall then Germany is better off than most other Eurozone countries and likely to see less of a contraction in overall growth than the Eurozone as a whole, but that doesn’t mean it will be plain sailing and that it won’t take a long time to recover.

Click here to access the Economic Calendar