Risk-on positioning has supported the Dollar and Yen, driving underperformance in commodities and other currencies with a higher beta characteristic.

Multiplying coronavirus infections across the US and in other places across the world, including Tokyo, Hong Kong and Melbourne, along with a number of clusters in Europe, have spooked investors. The US reporting a new daily record in new coronavirus cases, of 60k, together with yet another record number of deaths in Texas, has fuelled concerns about the impact a second wave and renewed broader lockdowns would have on the world economy. Mobile phone data compiled by Unacast has shown retail visits to have dropped in a number of states where there has been a spike in new Covid-19 cases.

News yesterday that the US Supreme Court said that the NYC Grand Jury could have access to President Trump’s tax returns and other financial records started the risk-off phase that is still prevailing. Wall Street has tumbled on the news, with the USA30 posting a -200 point decline, while USA100 and USA500 gains are fading fast. The decision from SCOTUS will keep Wall Street uneasy given the increased sensitivity to the November election. However, the Court has blocked access to the president’s records for now. Supposedly grand jury deliberations are to be kept secret, but that will heighten the potential for leaks and tape bombs prior to the November 3 election and that will make for jittery markets over the next few months.

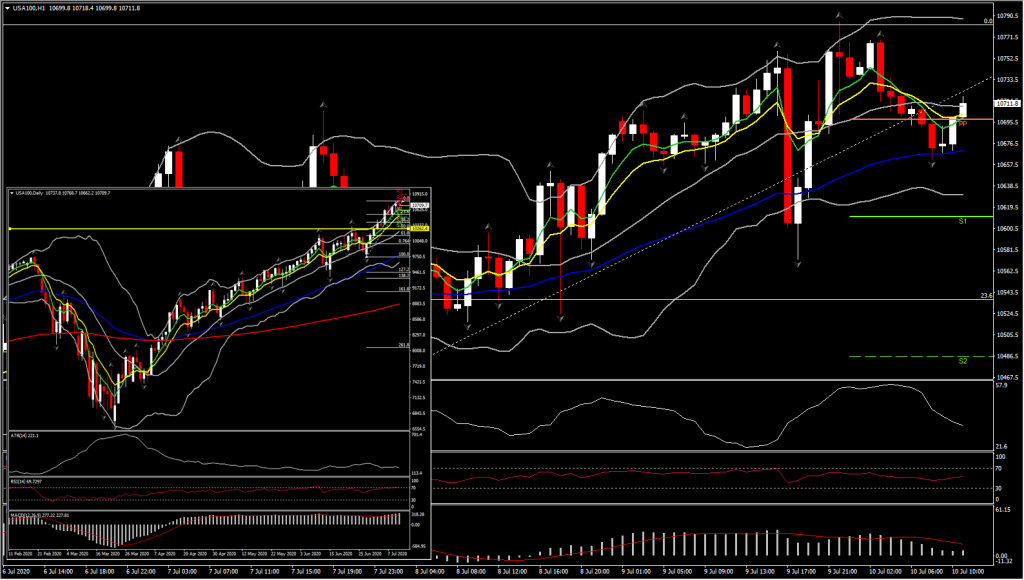

The USA100 initially clawed back and continued to outperform with a 0.5% gain to 10,784, another historic peak. But in the Asia session the decline resumed again, with the asset currently standing at 10,695 after it found some support at the 50-period EMA in the 1-hour chart (which has been supporting the asset since the end of June). For the USA100 technically, only a pullback below 10,200 Support could turn the attention to the 9,800 area and the 50-DMA. There is nothing overly bearish at this stage, as the asset has been in a rally since mid May, extending gains above all daily MAs, with momentum indicators strongly positive. Hence the early declines might be seen attracting buying pressure intraday, as the short term indicators, despite their turn lower, managed to sustain the neutral zone. The hourly chart shows the asset moving above fast MAs such as 20-period SMA, 9-period EMA and 5-period EMA. RSI is back above 50, however MACD lines continue to struggle above neutral.

Asian markets and European index futures have also dropped, including Chinese markets, which ends a retail-driven, Beijing-encouraged phase of outperformance.

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.