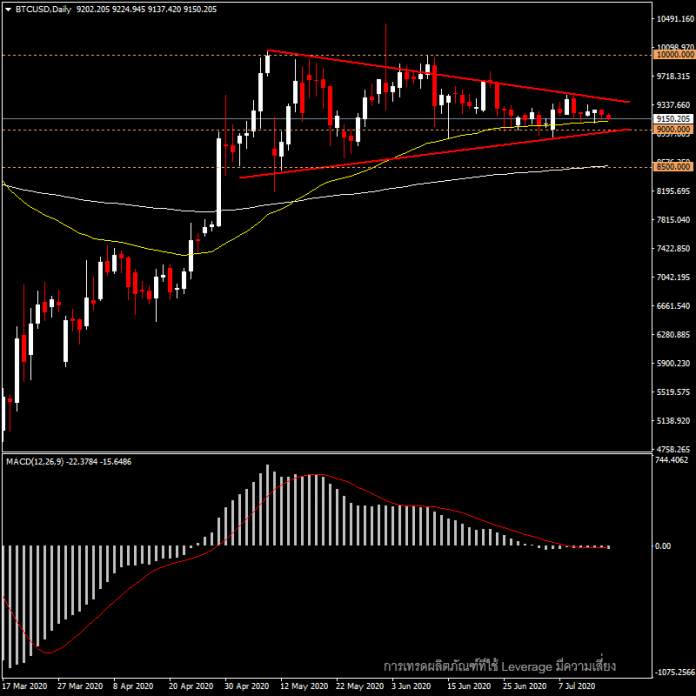

BTCUSD – After the easing of lockdown measures in May, Bitcoin prices continued to narrow in the 9,000 – 10,000 range. Since May though we have spotted a triangle formation that looks like a bullish pennant pattern that may see a bid if it confirms a break to the upside. The asset is supported by 50-day EMA and 200-day EMA 200. The asset has remained in a positive medium term outlook as it is sustaining the year’s highs. If the price breaks through the lower border first, however, it may retest the 8,500 level. Meanwhile, MACD indicator shows that momentum is currently declining in the negative territory.

As Bitcoin continues to circulate, the Chinese central bank’s Digital Yuan is about to launch a trial on the platform of China’s food delivery service provider Didi, backed by Tencent, which has more users. At the same time, the Japanese government is preparing to consider issuing a Central Bank Digital Currency (CBDC), which will be included in this year’s policy framework and may be done in cooperation with the United States and Europe.

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.