The American Express Company (AMEX) are scheduled to report 2nd quarter 2020 earnings before the market opens in New York today (July 24). The market is not expecting anything pretty, with the Zacks Consensus Estimate for the company’s second-quarter earnings and revenues pegged at $2.48 per share and $36.66 billion, indicating a plunge of 69.76% and 15.83% respectively from the prior-year reported figures.

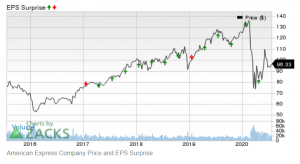

However, they do have a history of surprising the market. As the chart below shows, Earnings Per Share beat estimates in each of the last four quarters, delivering a surprise of 5.03% on average. So there may be better news than expected later.

But it has been an unquestionably difficult period for all firms, with many financial firms suffering more than most from the hit to US GDP due to the virus and the collapse in consumer spending, again particularly on credit cards. The card services section is likely to have been severely curtailed, hence the very weak outlook and expectations. The two other key areas of the business, small business loans and card member loans, are also expected to have declined significantly and underperformed. During the quarter there was significant pressure on costs too with added card reward programmes to stimulate card use and retain customers, however there were also significant reductions in advertising, sponsorship and overall marketing which should have controlled expenses.

Wall Street has turned sour on the stock on the run up to the earnings with all seven of the last updates issuing down grades. The most negative being UBS who have turned from Neutral to a Sell recommendation, while JP Morgan (who have turned to Underweight from Neutral) have the lowest target price at $97.00. Overall of the 29 Wall Street analysts following AMEX, 7 have a BUY or Strong BUY, 15 Hold, 6 Neutral or Underperform and 1 Sell.

Technically, the share price has recovered from the $76 lows in May (and the Q1 March nadir at $65) to peak over $116 in June, and be currently capped at a key resistance level around $98.00. A break of this level and then the 61.8 fib level at $105 is the next key resistance. Immediate support is the recent low and Daily trendline at $95 and then the July low and weekly trendline at $89.00. The MACD signal line and histogram are showing signs of life, but remain below the 0 line. RSI too is neutral at 51.6.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.