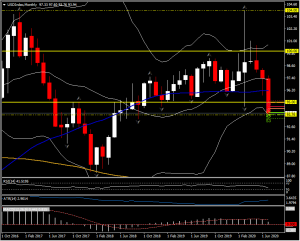

The Dollar continues to drop, printing fresh trend highs against the Euro and other currencies. The narrow trade-weighted USDIndex (DXY) fell over 0.5% to a 22-month low at 93.76 in what is now the seventh consecutive day of decline and the fourth straight week the index has surpassed its prior-week low.

Momentum has also been accelerating to the downside over the last week. EURUSD concurrently printed its loftiest level seen since January 2018 at 1.1724. USDJPY fell by over 0.6% in pegging a four-month low at 105.39. AUDUSD and NZDUSD lifted by around 0.5% apiece, though both pairs remained off recent trend highs. USDCAD ebbed moderately, lacking impetus for a challenge of last Thursday’s seven-week low at 1.3349. Front-month USOil prices are softer, but have so far remained within the range seen on Friday.

Cable posted a near five-month peak at 1.2858, despite losing about 0.3% against the Euro, Yen and Australian Dollar, among other currencies. The Pound’s laggard performance comes amid increasing signs that the EU and UK are only likely to strike a narrow trade deal, with the risk remaining that the UK might even leave the single market at year-end without a deal.

As for the Dollar, the currency is being down-weighted in portfolios, partly on the advent of the EU’s recovery fund, seen as a milestone by many analysts (a new liquid AAA fund that also reduces Eurozone breakup risks), and partly amid expectations for dovish guidance from the Fed at this week’s FOMC. There has been some speculation that the US central bank is considering yield curve targeting (which we don’t anticipate anytime soon).

Global stock markets continue to exhibit a flagging price action, being richly valued and as the pace of global economic recovery is flattening out somewhat, along with US-China tensions rising from simmering to bubbling. Gold prices hit new highs above $1,900, at $1943, reflecting investor concerns that the massive (and ongoing) stimulus measures around the world will lead to an inflation spike.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.