Apple INC (NASDAQ:AAPL), will post its Q3 earnings (ends June 2020) results this Thursday July 30th after market close followed by a conference call to discuss the Q3 results at 22:00 GMT.

The technology company, which is among the largest in the world, innovated with its development in technology in computers, cell phones, wearables and services, among other things, and has the largest market capitalization in the world with a current value of $1,643,753,205,400. The COVID-19 outbreak has affected many companies, including Apple, which closed several stores around the world and took special measures for workers in its suppliers in China. Apple further maintains precautions by not ruling out the possibility of a second wave.

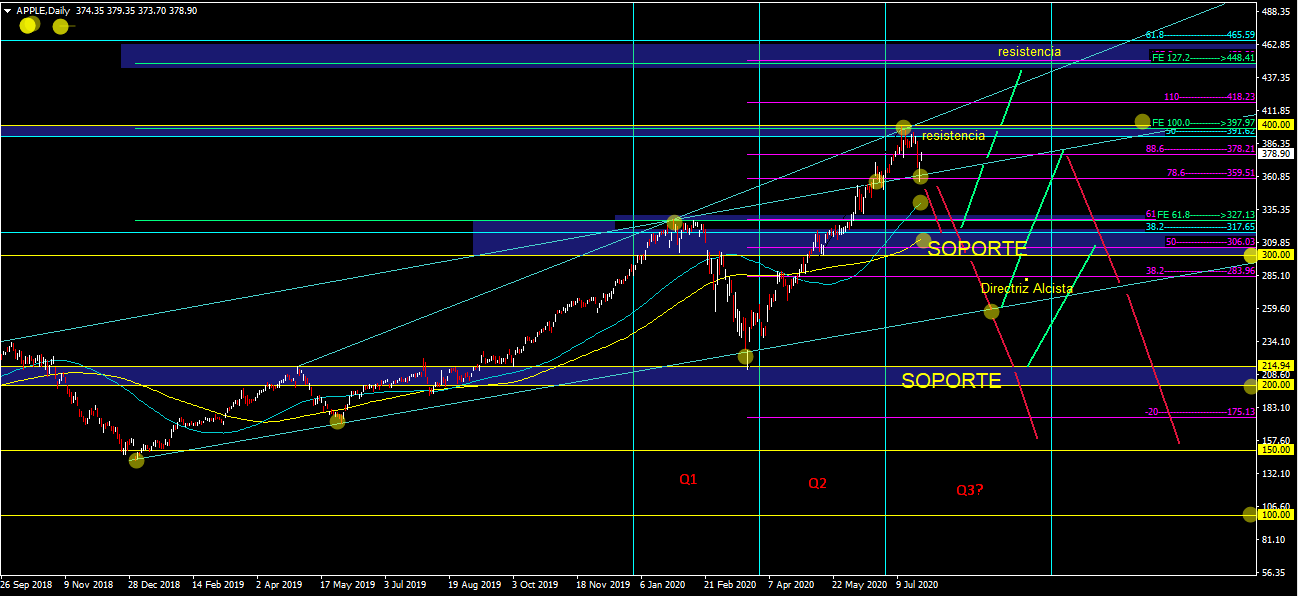

Despite all this, Apple has not only stayed afloat but it is expected that its Q3 earnings will exceed expectations, as it has in the last 8 quarterly reports. Since the low marked in March of this year at the support of $214-$200, a price we have not seen since October 2019, the only thing it has done is rise, from $237 at the beginning of the quarter to a high of almost $370 at the end of the quarter, representing an increase of +60%. Currently it is at $378.90 at the time of this article.

During the year Apple has risen more than 26%, and Q3 revenue is expected to be $55.1 billion, more than 7% over the estimated $51.77 billion, as a result of the sale of hardware and profits from services. EPS is expected at $2.18 (as of Q2 of 2019), 8% higher than the estimate of $1.99.

“June quarter results likely to outperform consensus estimates on the back of better than expected hardware sell-in. We currently forecast June quarter revenue and EPS of $55.1B and $2.18, 7% and 8% above current consensus estimates, respectively, on the back of stronger than expected intra-quarter data points across nearly all Product segments. We currently forecast $24.1B and $4.9B of iPhone and iPad revenue, respectively, in the June quarter vs. consensus of $22.4B and $4.9B. We currently forecast June quarter Services revenue of $13.4B (+16.7% Y/Y), 1% above the consensus estimate of $13.2B (+15% Y/Y) and nearly 5 points higher than our original June quarter Services forecast largely due to record results from the App Store, which we estimate grew 30% Y/Y in the June quarter, the fastest quarterly growth in 3 years, as consumers remained at home for much of the quarter”

Katy L. Huberty, equity analyst at Morgan Stanley.

Technical analysis

There was a drop in the first quarter after hitting the current support of $300-$327 and an almost impeccable and constant rise during the second quarter to $400 including the beginning of Q3, prices we have not seen since 2013.

We are at a point of resistance where maintaining it would lower the support from $300-$327 to resume the rise to $400 again where it would double or break until we see the price reach the next resistance at $450. If we break the $300 support, we would expect the drop to the channel’s bullish guideline for a rebound or break it to the support of $200-$214.

ADX above 60 and with divergence between the maximum of Q1 and the point of $400, would assume a fall to some of the supports levels..

Aldo Weidner Zapien , Market Analyst – HF Educational Office – Mexico

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.