Eurozone manufacturing PMI revised up to 51.8 in the final reading for July – versus 51.1 reported in the preliminary release. The jump from 47.4 in June reflects the further opening of economies and puts the manufacturing sector firmly back in expansion territory. Markit reported gains in both output and new orders, although the survey also highlighted that severe job cutting continues as companies continue to operate below capacity. This highlights that while production is coming back, levels remain far below those seen at the same time last year, which means it will be a long way back to pre-crisis levels, especially as a renewed pick up in new virus infections is prompting regional lockdowns.

EU officials have vowed to try and prevent any new border closures, but that resolve is being tested in some places and Germany is moving towards compulsory virus tests at airports, which are already available free of charge for those returning from “risky” areas. Companies are seeing a comeback in both domestic and external demand, which is encouraging, although clearly job cuts remain a major concern and we see the risk of a rise in structural unemployment in coming years as the pandemic is likely going to lead to deeper structural changes in supply chains and production models.

Meanwhile, the European stock markets are broadly higher, after solid final manufacturing PMI readings. The GER30 is leading the way with a 1.4% gain, while the UK100 has pared earlier losses and is now up 0.2%. The Euro Stoxx 50 has gained 0.8% so far and while there are some pockets of weakness still, the overall sentiment seems to be cautiously optimistic as surveys signal an ongoing recovery.

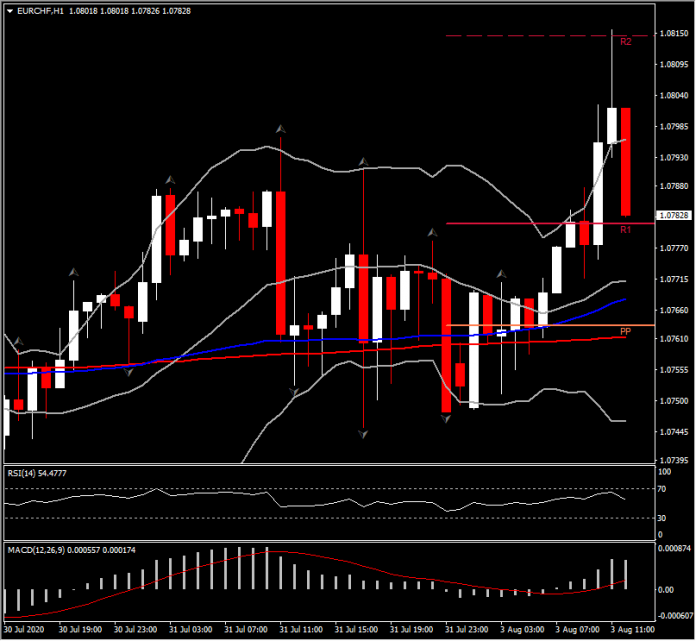

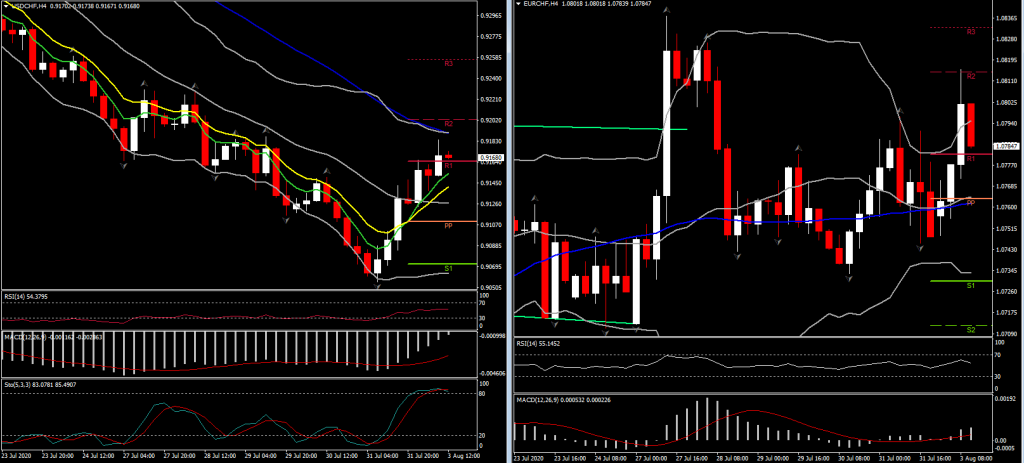

In the forex market meanwhile, a notable EUR cross has been the EURCHF after it posted a noticeable drop last Monday, with the Swiss Franc currency showing a loss of over 0.5% against both the USD and EUR. The influence of the SNB’s intervening hand seems to be in play. Weekly sight deposit figures out of Switzerland have been suggesting that the central bank has been continuing to sell francs regularly, as it has been since the consequences of the pandemic took a grip on markets, which had the impact of increasing demand for the Swiss currency. SNB total sight deposits w.e. 31 July were at CHF 693.7 bn vs CHF 692.6 bn prior. A rise in sight deposits (money held by commercial banks) can suggest francs turning up after being sold by the central bank.

Last Monday, EURCHF made a rare appearance on the ‘biggest daily mover’ list out of the main USD pairs and associated cross rates, when it showed a 1% gain in one day. A 2-month high was pegged at 1.0837 before the cross took a rotation lower. The high so far today is at 1.0815, with immediate Support at 1.0730. However the asset has seen a drop of around 30 pips after the better than expected Eurozone PMIs, with CHF correcting some of the early losses.

However, the asset’s overall outlook remains positive with momentum indicators positively configured and as Daily DMAs, 20- and 200-day SMA confirmed a bullish cross on Friday. Hence as long as the asset sustains a move above 1.0720, which is the confluence of 200 DMA and 61.8% Fib from July’s upleg, the bias remains positive. The 7-month peak, seen in early June, is at 1.0914.

The advent of the EU’s recovery fund, seen as a milestone by many analysts (a new liquid AAA fund that also reduces Eurozone breakup risks) has by many accounts caused a re-weighting of the common currency in portfolios, which will help the SNB combat what it sees as a chronically overvalued franc, in order to keep the Swiss economy from falling into the deflation pit.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.