The Dollar has been ebbing moderately lower into the London interbank open, though has largely remained above lows seen on Monday. The USDIndex (DXY) drifted to a 93.25 (S1) low after yesterday’s rebound capped out at a six-day high at 93.95. This has come amid a risk-on backdrop, which has propelled the MSCI Asia-Pacific index to gains of over 1%, along with lifting US and European equity index futures. Strong manufacturing data out of the US and elsewhere yesterday, continued gains in tech stocks, and Germany’s IFO institute stating that there are signs of recovery in the auto manufacturing industry, have been bullish tonic for asset markets, offsetting the stalemate on Capitol Hill over the next pandemic fiscal support bill and anxieties about Hurricane Isaias. New Jersey governor has declared a state of emergency as the US Atlantic coastal states brace for the storm.

EURUSD lifted moderately, posting an intraday high at 1.1800, extending the rebound from yesterday’s eight-day low at 1.1696. Cable saw a similar price action, making a rebound peak at 1.3106 after setting a five-day low at 1.3004 yesterday. USDJPY plied a narrow range pivoting through 106.00, holding well within Monday’s range.

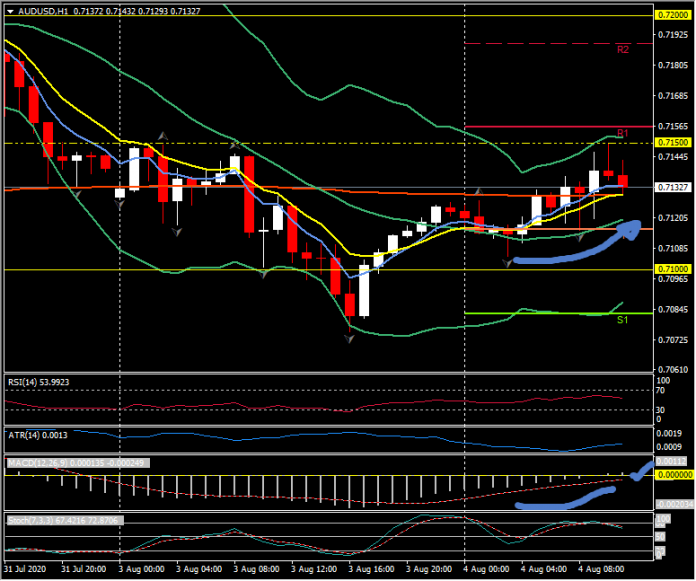

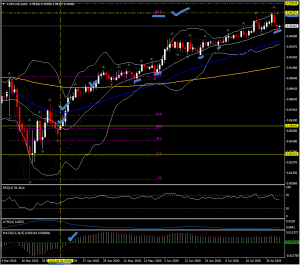

AUDUSD lifted to an intraday high at 0.7150, and above yesterday’s peak. The RBA left its cash rate unchanged following its August policy review today, and announced a resumption in bond buying from tomorrow “to ensure the yield on 3-year bonds remains consistent with the target” of around 25 bp. The RBA adopted yield curve control back in March. Regarding the outlook, the central bank highlighted a likely “uneven and bumpy” recovery in the state of Victoria, which has gone into lockdown in response to a flare up in coronavirus cases. The AUD remains in demand with Daily time frame charts showing gains across the board, with AUDCAD the best performer and into its 85th day above its 20-day moving average, with AUDJPY and AUDUSD above that key indicator for 24 and 23 days respectively.

Elsewhere, USDCAD ebbed to a five-day low at 1.3358. Front-month USOil prices remained buoyant after yesterday hitting a five-day high at $41.22. Gold prices pivot through $1975 today down $10-$15 off of yesterday’s nominal record peak at $1,987.00.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.