There was no real surprise from the BoE this week, although those looking for a clear signal that additional easing measures are underway and that a shallow recovery will force the central bank to join the negative rates club were disappointed. The Bank Rate was left unchanged at 0.1% and the target for the total stock of assets was kept steady at GBP 745 bln. The overall message was that of cautious optimism on the outlook, with the BoE pledging to keep monetary policy very accommodative as long as necessary. So officially it seems the central bank is in wait and see stance. However, the details of the report as well as separate comments from BoE governor Bailey highlighted plenty of downside risk ahead, and speculation that the BoE will be forced to extend the asset purchase target again later in the year is unlikely to disappear.

And while the bank’s Financial Policy Committee says companies continue to face a severe cash-flow shock and that many will need further financing to survive the disruptions, it ultimately concluded that the banks’ capital buffers were more than sufficient to absorb the losses, even in more adverse scenarios. That banks will face higher levels of toxic loans as not all companies will be able to survive the crisis seems very likely. The BoE needs banks to continue lending in order to underpin domestic demand and warned that it would be “costly for them and for the wider economy to take defensive actions” and that it was in their collective interest to continue supporting households and businesses. Indeed, the BoE’s reluctance to introduce negative rates also relates to the fact that with banks’ balance sheets negatively affected by the period of severe economic disruptions, “negative policy rates at this time could be less effective as a tool to stimulate the economy”.

Plenty of downside risks then even by the BoE’s own admission, but the sentiment signaled by the main policy statement clearly was that of cautious optimism with near perfect scenarios defining the central policy outlook and a wait and see stance – at least for now. BoE governor Bailey himself actually sounded somewhat less sanguine in a Bloomberg interview and stressed that “there is an awful lot of risk in there and it’s obviously distributed one way”. Against that background the BoE will be “ready to lean in and support that“. So while negative rates are off the table for now, expectations that the central bank will be forced to extend the asset purchase target further later in the year are unlikely to disappear.

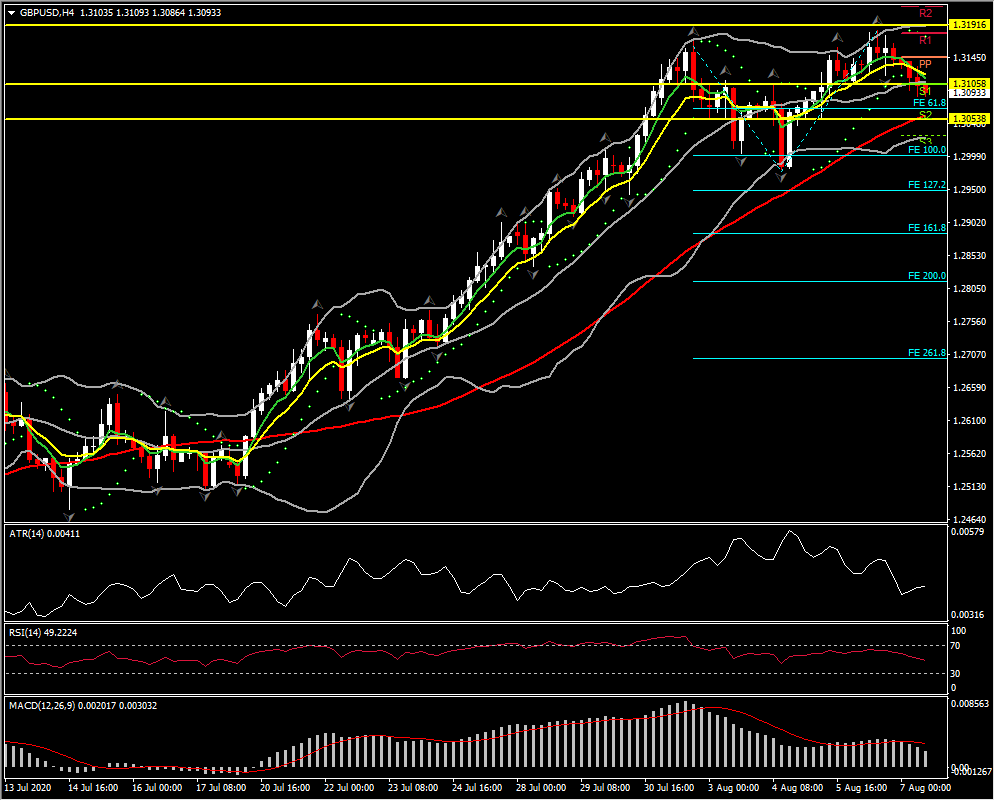

Cable posted a fresh two-day low at 1.3086, drawing back from the 1.3187 five-month peak seen Thursday following the BoE’s deliverance of a warily upbeat outlook. The Pound has also corrected from the post-BoE highs seen against the Euro and other currencies. Following a phase of outperformance, we are taking a circumspect view of the pound’s upside potential. Both Manchester and Aberdeen are back in lockdown.

The city of Leicester, however, has reopened after being locked down for most of the past month. There has been no follow-through from higher new cases in Leicester to an event-impact of corresponding higher hospital admittances and mortality (note that the test for the coronavirus cannot distinguish between whether the virus is ‘live’ or is debris from a prior infection of the virus). Regarding the coronavirus, there are two schools of thought: one is that only a tiny fraction of the population has built up an immunity to SARS Cov-2 and, ergo, there is a significant risk of a frightening second wave; the other (which, importantly, recognises that the coronavirus has been in Europe since last October, as sewage samples have proven) is that the virus has already spread through a large part of the population and a communal immunity has been built up (the unfortunate consequence being that vulnerable groups have been badly affected), with the mortality outcome of about 0.05% consistent with a classic Gompertz curve of respiratory illness cycles, albeit a relatively bad one.

The Leicester experience adds weight to the latter school of thought. Either way, the new lockdowns, and ongoing “feardemic” as winter approaches, have potential to erode economic recovery metrics. Brexit also remains unresolved, although off the agenda for now during the summer break. Talks are scheduled to resume on the week of August 17th.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.