The global recovery continues to track a “V” rebound from the April lows. But not surprisingly there’s considerable variability in the height of the bounce, and uncertainty over the trajectory into Q4. While the path of the pandemic remains the underlying key to the recovery, this week’s calendar that includes central bank events, data, politics, and supply, will help shape growth expectations over the rest of the quarter.

Stocks have rallied significantly on the month, underpinned by massive fiscal and monetary stimulus and strength in big tech, but also gains in economically sensitive stocks amid rising optimism over a faster than expected comeback. Concurrently, Treasuries and core EGBs richened on expectations for a dovish tilt out of the Jackson Hole symposium.

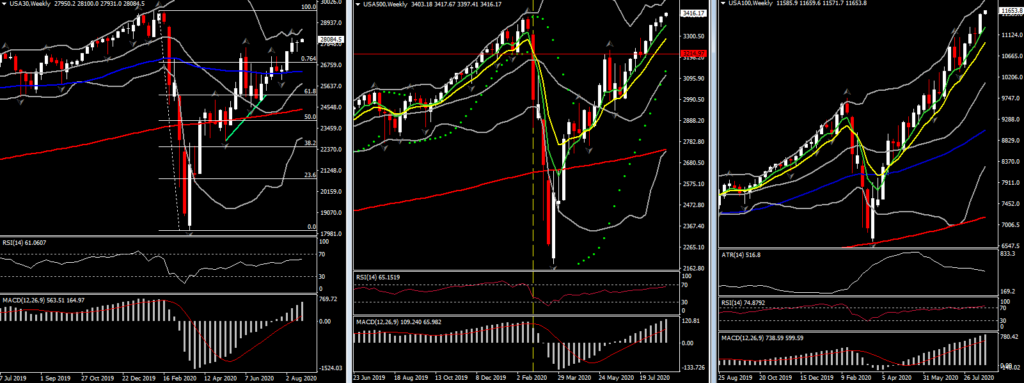

While heat waves are baking much of the US, firm economic data has cooled fears that the recovery is stumbling amid the lack of new unemployment benefits and continued virus concerns and continued mitigation measures with reopenings still very limited. Nevertheless, Wall Street has rallied, achieving record highs on the USA100 and USA500, better than 5% gains on the USA100 and USA30 for the month, and a 3.9% increase in the USA500.

Though most of the strength has come from big tech, which has benefited from the pandemic lockdowns, outlooks for an improving economy has seen some rotation into the beaten up sectors. As for Treasuries, they’ve recovered about half of the month’s selloff. Yields spiked mid-month after stronger than expected inflation data, poor receptions to longer-dated auctions, and a lack of clarity in the FOMC minutes over a shift in its inflation strategy. However, a re-think ahead of this week’s Jackson Hole Symposium and expectations Chair Powell will indicate a move to an average inflation target knocked yields lower.

The 2020 Economic Policy Symposium from Jackson Hole takes top billing (Thursday, Friday). This year’s theme is a fitting one: “Navigating the Decade Ahead: Implication for Monetary Policy” (note that in this age of COVID, the event will be live streamed). The main event will be Fed Chair Powell’s speech (Thursday, 9:10 ET) on the Policy Framework Review. By all hints from the Fed, including the July FOMC minutes, the FOMC is preparing to shift to an average inflation goal, allowing prices to run hot in order to make up for the decade of underperformance.

The Review is seen that it would be completed by and announced at the September 15, 16 FOMC, though the July minutes indicate it has not yet been completed, so Powell may not be able to outline details or a time-frame. Others in attendance include BoC’s Macklem (Thursday) and BoE Governor Bailey (Friday).

Along with Jackson Hole (Thursday, Friday), politics will consume the US airwaves with the Republican National Convention (Monday-Thursday). Speaker Pelosi recalled the House for a rare Saturday vote on a Postal Service bill, though it was not taken up by the Senate which is still on recess. Meanwhile, the two bodies remain stalemated over another pandemic relief measure. US data includes housing numbers, confidence, durable goods, income, consumption, revised Q2 GDP, and claims. And there’s a ton of supply with record 2-, 5-, and 7-year auctions. Canada has the much awaited Q2 GDP report. In Europe, the resurgence in cases amid summer travel is the focus, with the latest set of Eurozone confidence numbers on the docket that will inform ECB expectations and the policy outlook. There’s little out of Asia this week with just a policy meeting from the Bank of Korea.

COVID-19 will remain a major issue globally, with very mixed outcomes. Cases have climbed above 23 mln and deaths are now over 800k. But there’s been rising hope for a vaccine. Russia claims to have developed the first, amid tough controversy over testing. Concurrently, a couple of drugs are in late stage human trials. And there are signs of some areas, including parts of NY and London, achieving significant immunity. But on the more pessimistic side, schools around the world are having very limited success in reopening. Germany recorded its highest number of infections since April. Cases and deaths have increased in Arizona, but have slowed in Florida.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.