With all eyes on Powell, FX markets traded within a narrow range overnight. GER30 and UK100 futures meanwhile are both up 0.1%, while US futures are slightly in the red after producing fresh record highs for the USA500 and USA100 yesterday, while most Asia stock markets have beaten a retreat.

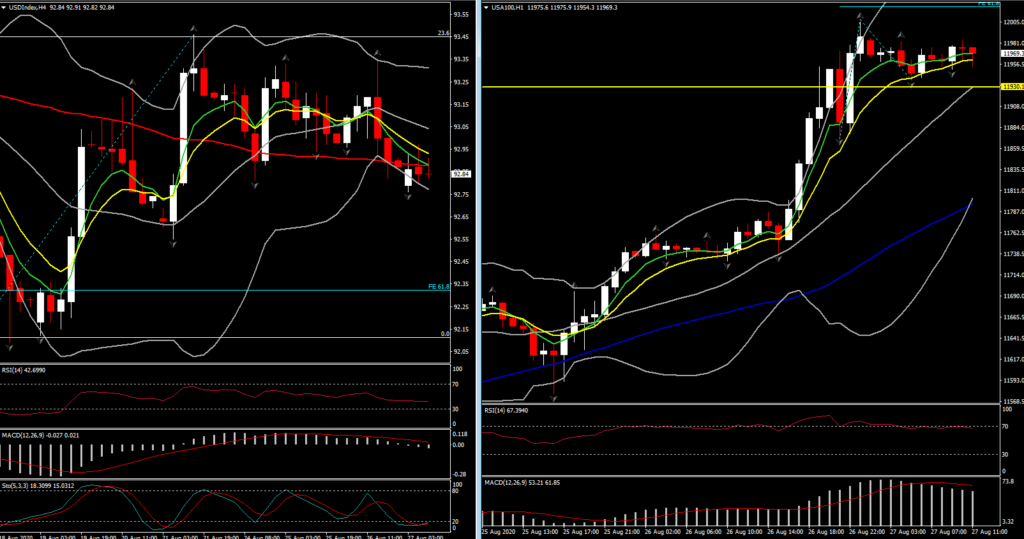

The USA100 is holding above the latest near term support at 11,930. The technical picture remains strongly positive for Wall Street in general not only on risk appetite gains but also on tech stocks rally after the reports from Bloomberg that Amazon’s founder and Chief Executive Jeff Bezos has become the first billionaire in modern history to cross the $200 billion mark as the shares of his company rose to a new high. His wealth is now almost double that of the second richest person in the world, Microsoft founder Bill Gates,

Let’s turn back to the USA100 though, in which the “buying the deep” strategy has been seen so far in the near and medium term. Buying into near term weakness remains a viable strategy. Today will be an interesting session as depending upon the perceived level of dovishness of the speech, there could be a sizeable influx of volatility.

Fed Chair Powell’s Jackson Hole speech later today (Thursday) is much anticipated. The markets are looking for more of an update on the FOMC’s Framework Policy Review. The Fed has been discussing a shift in its inflation strategy to targeting an average price target, versus the 2% mark, which would allow an overshoot of price pressures to make up for the underperformance over the last decade. As suggested by the FOMC minutes and by KC’s George earlier today, not everyone on the Committee ascribes to this shift. Obviously there was no decision at the July 28, 29 meeting, though one is expected to be made at the September 15, 16 meeting.

Even though no one really expects the FOMC to even start to think about thinking about raising rates for a couple of years, any indication from Powell that there’s more opposition to a shift, or that an announcement won’t be made next month, won’t sit well with the markets.

Meanwhile, there is a risk markets will be disappointed as he may not yet be in a position to deliver in terms of specifics on inflation targeting changes or other policy rubrics. The FOMC hasn’t completed its framework review, and there are known differences of opinion among Committee members. Any sense of disappointment would likely catalyze a rebound in the USD.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.